marselblog.ru Prices

Prices

Social Security For Green Card Holders

As long as you are in the US legally and remain a permanent resident, you collect the benefits. There is no requirement for US citizenship. In. If you are not a U.S. citizen or legal Permanent Resident Alien (“Green Card” holder) and you need to verify the details shown on your Social Security Number. If a green card holder resides in the United States long enough, they may receive social security benefits. You may apply for a wide variety of jobs. Green. Change of Address · Travel · Social Security Number · Selective Service Registration · Taxes · PR Renewal/Extension · For Additional Resources, see. When Are Noncitizens Eligible for SSDI? If you have a green card (that is, if you're a lawful permanent resident) and you've worked long enough in a qualified. Hi, does anyone happen to know if green card holders that have been in the US for under 5 years are eligible for SSI? You may be eligible for. SSI if you are: • Lawfully admitted for permanent residence. • Granted conditional entry. • Paroled into the United States. • Admitted. • Lawful permanent residents (LPRs)are foreign nationals permitted to live in the United States permanently (also referred to as green card holders) It marselblog.ru noncitizens in certain immigration statuses are allowed to apply and receive a Social Security number (SSN) and card. These include. As long as you are in the US legally and remain a permanent resident, you collect the benefits. There is no requirement for US citizenship. In. If you are not a U.S. citizen or legal Permanent Resident Alien (“Green Card” holder) and you need to verify the details shown on your Social Security Number. If a green card holder resides in the United States long enough, they may receive social security benefits. You may apply for a wide variety of jobs. Green. Change of Address · Travel · Social Security Number · Selective Service Registration · Taxes · PR Renewal/Extension · For Additional Resources, see. When Are Noncitizens Eligible for SSDI? If you have a green card (that is, if you're a lawful permanent resident) and you've worked long enough in a qualified. Hi, does anyone happen to know if green card holders that have been in the US for under 5 years are eligible for SSI? You may be eligible for. SSI if you are: • Lawfully admitted for permanent residence. • Granted conditional entry. • Paroled into the United States. • Admitted. • Lawful permanent residents (LPRs)are foreign nationals permitted to live in the United States permanently (also referred to as green card holders) It marselblog.ru noncitizens in certain immigration statuses are allowed to apply and receive a Social Security number (SSN) and card. These include.

USCIS transmits the data from approved applications to us to assign an. SSN. The SSN card is mailed to the address provided on the USCIS application. Please. Having a Green Card (officially known as a Permanent Resident Card (PDF, MB) allows you to live and work permanently in the United States. To get Medicaid and CHIP coverage, many qualified non-citizens (such as many Lawful Permanent Residents, also known as LPRs or green card holders) have a 5-year. —People with Lawful Permanent. Resident status. • The 2nd type of card shows your name and number and notes,. “VALID FOR WORK ONLY WITH. DHS AUTHORIZATION. Yes green card holders are able to get benefits. Once you earn 40 credits (equivalent to 10 years of work) you are eligible for benefits. You can now request your Social Security card (and replacement card) while applying for your green card or while applying for work authorization. When. As a Green Card holder, will I get a social security number? As a permanent resident, you can get a Social Security number (SSN). A Social Security number is a. If you contributed to Social Security for 40 quarters as a legal worker, you qualify for benefits. However as a non-citizen you generally. you must go to a Social Security office to apply for a Social Security number and card as soon as you have a permanent address in the United States. There, a. If you apply for SSI benefits, you must give us proof of your immigration status, such as a current DHS admission/departure Form I, Form I, or an order. Find out if you are eligible for public benefits as a green card holder, such as Medicaid, Medicare, SSI, Social Security, food stamps, & public housing. I, Permanent Resident Card (green card). • I, Employment Authorization Document (EAD, Work Authorization Card). NOTE: Students and exchange visitors. Acceptable immigration documents include your: • Form I (Lawful Permanent Resident Card, Machine-. Readable Immigrant Visa). • Form I . For noncitizens applying for lawful permanent residence using the U.S. Department of State's application for an immigrant visa (using DS or DS) For. We have a way for noncitizens to apply for Social Security number (SSN) cards as part of the immigration process. We issue three types of Social Security cards. All cards show your name and Social Security number. If you are not a US Citizen or lawful permanent resident. Q: If an individual's Social Security Administration account card is not available, what other documents. Legal immigrants can qualify for Social Security benefits if they earn enough work credits over their careers. · To earn credits in the U.S., immigrants need to. An individual who is not a U.S. Citizen is potentially eligible for Supplemental Security Income (SSI) under certain circumstances described below. When you are admitted into the United States as a lawful permanent resident (green card holder), the Department of Homeland Security sends your information.

Calculate Capital Gains Tax Crypto

Professional traders cannot benefit from the 50% capital gains tax rate. Tax Planning Strategies for Cryptocurrency Investors. To optimize tax outcomes and. Attach transaction reports from exchanges to calculate capital gains. It will even generate a file you can upload to turbo tax. Sign up to chat. Crypto tax calculator. Quickly calculate how much tax you owe from your crypto trading, staking and mining profits. Do I owe capital gains tax on a sale of cryptocurrency? You will generally tax return and should be included in your Washington capital gains calculation. Capital Gains Tax (CGT) on Chargeable Gains This use of crypto-assets is a disposal for CGT purposes upon which Dave must calculate the gain arising. Calculate Crypto Gains from different exchanges for Income Tax Return Filing in India using Profit / Loss statement or Crypto Ledger Template. Crypto Tax Calculator ; Total Capital Gains Taxes ; Disclaimer: The information returned in response to your query is only intended as a general estimate. A Cryptocurrency Tax Calculator is a tool designed to help you figure out how much tax you owe on your cryptocurrency transactions. You input data such as your. If the price has decreased, you have a capital loss. To calculate a capital gain - you need to start with your cost basis. This is the price you bought the. Professional traders cannot benefit from the 50% capital gains tax rate. Tax Planning Strategies for Cryptocurrency Investors. To optimize tax outcomes and. Attach transaction reports from exchanges to calculate capital gains. It will even generate a file you can upload to turbo tax. Sign up to chat. Crypto tax calculator. Quickly calculate how much tax you owe from your crypto trading, staking and mining profits. Do I owe capital gains tax on a sale of cryptocurrency? You will generally tax return and should be included in your Washington capital gains calculation. Capital Gains Tax (CGT) on Chargeable Gains This use of crypto-assets is a disposal for CGT purposes upon which Dave must calculate the gain arising. Calculate Crypto Gains from different exchanges for Income Tax Return Filing in India using Profit / Loss statement or Crypto Ledger Template. Crypto Tax Calculator ; Total Capital Gains Taxes ; Disclaimer: The information returned in response to your query is only intended as a general estimate. A Cryptocurrency Tax Calculator is a tool designed to help you figure out how much tax you owe on your cryptocurrency transactions. You input data such as your. If the price has decreased, you have a capital loss. To calculate a capital gain - you need to start with your cost basis. This is the price you bought the.

Any income earned from cryptocurrency transfer would be taxable at a 30% rate. Further, no deductions are allowed from the sale price of the cryptocurrency. If you purchase 1 BTC for $10,, that is your cost basis, which is then used to calculate any capital gain or loss from disposing of it thereafter. Tracking. How to Use the Cost Basis and Capital Gains Calculator · 1. Once in the spreadsheet, go to File -> Make a copy. · 2. Enter a Bitcoin or Ethereum wallet address . Crypto Income Tax Due"? c)HMRC requires one to provide one document I just wanted to confirm that: a)when calculating capital gains tax due: I. Long-term Capital Gains Tax Rate: If you HODL your crypto for more than a year, you'll pay a lower long-term Capital Gains Tax rate of between 0% to 20%. Rollover and exemptions. • Personal use assets. • Calculate CGT correctly. Keep good records. It's important to keep good records of all crypto transactions. If. Income from the transfer of digital assets such as cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., is taxed at a flat rate of 30% without allowing. Quickly know how much Capital Gains Tax you owe on your profits from property, shares, crypto and more. You exchanged one cryptocurrency for another. Say you traded bitcoin (BTC) for ethereum (ETH) at a profit. Your taxable gain for this transaction would be the. This tool can help you estimate your capital gains/losses, capital gains tax, and compare short term vs. long-term capital gain. When you sell your crypto, you can subtract your cost basis from your sale price in order to figure out whether you have a capital gain or capital loss. If your. This means your capital gain is $15, But the good news is that you owned the cryptocurrency for more than 12 months, so you only need to pay tax on $7, Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions. If you've purchased and sold capital assets, such as stocks or cryptocurrencies, then you might owe taxes on the positive difference earned between the sale. The government has proposed income tax rules for cryptocurrency transfer in Budget Any income earned from cryptocurrency transfer would be taxable at a capital gains or business income tax after selling or mining cryptocurrency calculate their capital gains. This means that taxpayers have to average. Calculate how much personal income tax you pay on income from cryptocurrencies and other capital gains in the Czech Republic. Automatically calculate your crypto tax report. Simply import your crypto trading history and Recap instantly calculates your capital gains and income taxes. Q How do I calculate my gain or loss when I exchange my virtual currency for other property? In chronological order: you bought bitcoin, traded short term for ETH, and then sold that ETH long term for fiat. Your capital gains tax will be calculated.

What Prepaid Cards Help Build Credit

In the long run, you may find that your prepaid business credit cards build credit indirectly by helping you make better spending decisions with other payment. A secured Credit Card from Fifth Third Bank is a smart way to help you establish or rebuild good credit. Apply today. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score. If. Extra allows you to build credit without a credit card and earn rewards points. Please see terms, credit may be offered by Lead Bank. We created Extra to help. For those who are trying to build or rebuild their credit, secured cards can be beneficial in helping reach credit goals. A secured credit card could help you build your credit history2 to make more things possible tomorrow. Your credit line will equal your deposit amount. How a credit card can help. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very. Prepaid debit cards cannot be used to build credit history. Your response. In the long run, you may find that your prepaid business credit cards build credit indirectly by helping you make better spending decisions with other payment. A secured Credit Card from Fifth Third Bank is a smart way to help you establish or rebuild good credit. Apply today. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. A secured credit card is an appropriate option for building or rebuilding credit if your goal is to establish a credit history or boost your credit score. If. Extra allows you to build credit without a credit card and earn rewards points. Please see terms, credit may be offered by Lead Bank. We created Extra to help. For those who are trying to build or rebuild their credit, secured cards can be beneficial in helping reach credit goals. A secured credit card could help you build your credit history2 to make more things possible tomorrow. Your credit line will equal your deposit amount. How a credit card can help. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very. Prepaid debit cards cannot be used to build credit history. Your response.

Netspend's Better Credit Visa Card is a different kind of secured charge card. No credit check, no locked-up deposit, no interest, and helps build credit. A prepaid credit card actually does not do anything for your credit. It is basically like a reloadable gift card, except instead of being locked. A credit utilization rate of 30% or less can help improve your credit scores. Therefore, if you pay a $ deposit and your credit limit is $, you will need. These transactions don't help you prove you can repay debts. 2. Using a prepaid card. A prepaid card is your own money, loaded on to the card in advance. Get a First Progress Select Card and Earn 1% Cash Back Rewards! · Secure your credit line with your refundable security deposit – choose from $ $2, – with. Prepaid cards do not help build credit. · Prepaid cards often carry a high monthly fee. · Prepaid cards provide limited spending power. Most prepaid cards (sometimes called prepaid debit or stored-value cards) do not help you build a credit history. You might have to pay fees to activate, use. A prepaid card won't do anything at all for your credit unless the card issuer reports to the credit bureaus. There's no reason for them to. PREMIER Bankcard® Grey Credit Card · Pre-qualify with no impact to your credit score · Helping people build credit is our first priority – start your credit-. No credit card bill to pay. Avoid banks by loading money onto the card through phone, web, or at ATMs. · Pre-paid debit cards do not help you build credit. · Shop. Start building and improving your credit with a Capital One Platinum Secured credit card. Typically, using prepaid credit cards won't help you build credit. However, KOHO prepaid cards are different. Prepaid cards do not help build credit because they do not involve borrowing or repaying money, and therefore, do not report to credit bureaus. The classic secured card from Merrick Bank can be obtained with a security deposit of $ up to $ Recieve 1% unlimited cash back with the Serve Cash Back Visa debit card or enjoy free cash reloads with the Serve Free Reloads Visa debit card. How can a Prepaid Card Improve my Credit Rating? A prepaid card is not based on credit, which means you don't need to have a good credit history to get one. A secured credit card is a type of credit card that requires a security deposit as collateral. It is typically used by individuals with limited or poor credit. Use of the Key Secured Credit Card can help build your credit when the minimum payment is made by the due date, each month. 2. Please see the cardmember. The best prepaid and debit cards of · + Show Summary · Netspend® Visa® Prepaid Card · Netspend® Visa® Prepaid Card · Self - Credit Builder Account with Secured. True Link's Visa® Prepaid Card offers financial protection and independence for older adults, people with disabilities, and people in recovery from.

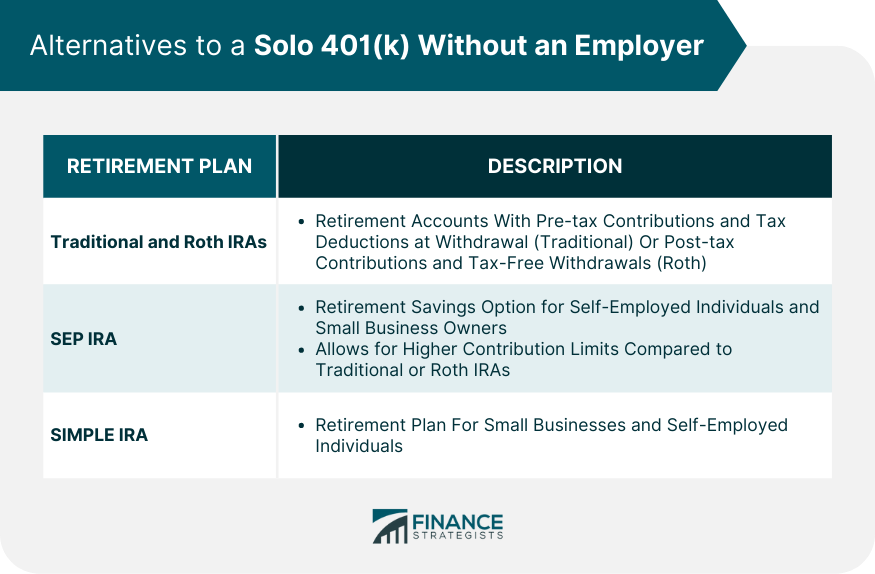

401k Without Employer

If you want to open a (k) just for yourself, you need to be self-employed with no employees of your own. Even if you have a job as someone. Key Points · One major benefit of a (k) is an employer match, but not all companies offer this perk. · Consider investing in an IRA before making unmatched A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. If you don't have access to an employer (k) plan, one option is to consider an individual retirement account (IRA), which could offer more and/or different. A traditional (k) is an employer-sponsored plan that gives employees a choice of investment options. Employee contributions to a (k) plan and any earnings. Unlike an Individual Retirement Account (IRA), (k)s are sponsored by employers. And if you are one of the millions of Americans who contribute a portion of. (k) plans are employer-sponsored plans, meaning only an employer (including self-employed people) can establish one. If you don't have your own organization. Direct rollovers. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without. If your company doesn't offer a (k) plan or you are self-employed, you'll need to join a separate financial institution. There you'll be able to open a (k). If you want to open a (k) just for yourself, you need to be self-employed with no employees of your own. Even if you have a job as someone. Key Points · One major benefit of a (k) is an employer match, but not all companies offer this perk. · Consider investing in an IRA before making unmatched A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. If you don't have access to an employer (k) plan, one option is to consider an individual retirement account (IRA), which could offer more and/or different. A traditional (k) is an employer-sponsored plan that gives employees a choice of investment options. Employee contributions to a (k) plan and any earnings. Unlike an Individual Retirement Account (IRA), (k)s are sponsored by employers. And if you are one of the millions of Americans who contribute a portion of. (k) plans are employer-sponsored plans, meaning only an employer (including self-employed people) can establish one. If you don't have your own organization. Direct rollovers. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without. If your company doesn't offer a (k) plan or you are self-employed, you'll need to join a separate financial institution. There you'll be able to open a (k).

Currently, employers have a choice of two different vesting schedules for employer matching (k) contributions. distribution without your consent. If. How much should an employer contribute to a k? · Match eligible employee contributions dollar for dollar up to 3% of compensation and 50 cents on the dollar. They are a valuable option for businesses considering a retirement plan, as they provide benefits to both employees and their employers. A (k) plan: ▫ Helps. Affordable (k) plan admin fees are covered by employers. Employees are only charged an annual account fee starting at %. 8. See our Form ADV 2A Brochure. No, you cannot get a K unless you work for a company that offers one. However, if you are self-employed, you can set up a SEP IRA. Different. Contact previous employers. It may seem obvious, but one of the quickest ways to track down an old (k) plan is to go directly to the source. And as the owner, you can contribute both as the employer and an employee. Benefits. A (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to. CalSavers is available to California workers whose employers don't offer a retirement plan, self-employed individuals, and others who want to save extra. Yes, you can. An Individual (k) is designed for a business owner without W-2 employees and, if married, the owner's spouse. The employer will establish the plan and name the plan administrator. Typically with the self-employed (k), the employer and the plan administrator are. (k) plans can be a good way to save for retirement, even without an employer match, mainly because they provide tax advantages. For example, many companies will add 50 cents of every dollar up to 6% of an employee's (k) contributions. But what if your employer's retirement plan offers. Employers who sponsor a (k) plan allow employees to save and invest some of their paycheck before taxes are deducted. Taxes are paid when the money is. If your employer does not offer a k plan or has stopped contributing to your plan, there are other retirement savings options available, such as individual. Those whose business is a side venture may also contribute to a (k) offered by an employer, but the combined contributions between both plans must not exceed. This program gives employers an easy way to help their employees save for retirement, with no employer fees, no fiduciary liability, and minimal employer. Without this relief, this notice is usually due at least 30 days before the An employer will need to amend its plan to suspend matching. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan. The cons: Once you roll your. If you are younger than 59 ½, you need to demonstrate that you have an approved financial hardship to get money from your k account without penalty. And.

Best Cheapest Tax Software

Examples include H&R Block, TaxAct, and FreeTaxUSA's software for individual taxpayers. What is the safest tax software? Intuit's products have garnered a. UltimateTax PPR. The UltimateTax Pay-Per-Return is online tax software for a minimal cost of $ per year. More. The Best Tax Software for ; Best Overall Experience. Intuit TurboTax (Tax Year ). Outstanding ; Best for Context-Sensitive Help. H&R Block Once Accounting, formerly BaCo Tech, is a software solution that unifies all accounting data to optimize tax preparation and planning. It has an intuitive year-. Cheapest Software to File Taxes Online · Top Software to File Taxes Online · Credit Karma · Tax Hawk (FreeTaxUSA) · Tax Slayer · Tax Act · Jackson Hewitt · H&R Block. best product for your tax needs. More Options for Electronic Filing. File online using approved tax software. Many of our Individual Income Tax forms. IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to. The ever-popular TurboTax is easy to use, has app support (multiple apps for self employed, tracking, etc), and includes live support. Reviewing. TurboTax is great for basic taxes under 50K, but doesn't handle real estate or other complicated tax issues. Free tax USA will do real estate. Examples include H&R Block, TaxAct, and FreeTaxUSA's software for individual taxpayers. What is the safest tax software? Intuit's products have garnered a. UltimateTax PPR. The UltimateTax Pay-Per-Return is online tax software for a minimal cost of $ per year. More. The Best Tax Software for ; Best Overall Experience. Intuit TurboTax (Tax Year ). Outstanding ; Best for Context-Sensitive Help. H&R Block Once Accounting, formerly BaCo Tech, is a software solution that unifies all accounting data to optimize tax preparation and planning. It has an intuitive year-. Cheapest Software to File Taxes Online · Top Software to File Taxes Online · Credit Karma · Tax Hawk (FreeTaxUSA) · Tax Slayer · Tax Act · Jackson Hewitt · H&R Block. best product for your tax needs. More Options for Electronic Filing. File online using approved tax software. Many of our Individual Income Tax forms. IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to. The ever-popular TurboTax is easy to use, has app support (multiple apps for self employed, tracking, etc), and includes live support. Reviewing. TurboTax is great for basic taxes under 50K, but doesn't handle real estate or other complicated tax issues. Free tax USA will do real estate.

There are features that the most basic tax software should have. These include multi-user access, e-filing, status reports, state modules, and vital schedules. TaxSlayer Pro includes everything you need to succeed and grow your tax preparation business. Tax software customer. Cloud-Based Tax Software. Embrace the. Discover tax filing software that makes DIY preparation easy. H&R Block offers a range of tax preparation software for everyone from basic filers to. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. Easy to use and a fraction of the cost of the other alternatives. Browse All Trusted Partners ; marselblog.ru · $68, or less ; TaxAct · $79, or less ; On-Line Taxes (marselblog.ru) · $45, or less ; FreeTaxUSA® · $45, or less ; Free Federal Filing; $ for State. at FreeTaxUSA ; File your taxes for as low as $ with TaxSlayer! Use Code: RMN at TaxSlayer ; $ at Cash App. Approved software. com · NOW · April · Cash App Taxes · Expresscom · marselblog.ru · marselblog.ru · marselblog.ru Backed by the Defense Department and made exclusively for the military community — with MilTax you can: Complete your tax return with specialized software that. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. Approved software. ATX · BlockWorks Online (BWO) · Crosslink · CCH ProSystem fx · DrakeTax · ELECTRO - · marselblog.ru · GoSystem · H&R. FreeTaxUSA's extremely low pricing starts at $0 for federal returns and $ for state returns that include self-employment income. This makes it our top pick. FreeTaxUSA delivers a budget-friendly tax product allowing for do-it-yourself tax filing with an option for expert help if needed. With the cloud-based service. Best tax software of August ; Cash App Taxes. Cash App Taxes · Learn More. Via Cash App's website · $0 · $0 ; TurboTax. TurboTax · Learn More. Via TurboTax's. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. "TaxAct - the simplest and smoothest way to file taxes. " Overall, TaxAct is. tax preparation software products (prices vary). Steps for using free Browsers: Free File Fillable Forms will work best when using the latest version of these. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can. The best online tax preparation software for professionals. It's fast, easy, & secure. Unlimited plans can grow your tax business. Start your free demo. TaxWise offers a wide selection of fee payment options; ranging from traditional refund transfer products (bank products), to low-cost options that help you. TaxAct is also more affordable than a number of other competitors when it comes to self-employed tax preparation software options. However, if you want access.

What Are The Best Drop Shipping Companies For Ecommerce

AliExpress, Walmart, Target, and eBay are some of the best US dropshipping suppliers. Similarly, Etsy, Sam's Club, Pure Formulas, and Shein are also notable. Provides access to over a million products from over suppliers, with an integrated system that works with most major e-commerce marketplaces. You can browse. Looking for the best dropshipping suppliers for ? Discover the top 10 suppliers to kickstart your business, from SaleHoo to, Modalyst to Printful. Looking for the best wholesale drop shipping companies? We've got you Learn how to start your own successful eCommerce business with this free mini. Doba is one of the most popular dropshipping services on the market today. Its popularity is largely due to the fact that it can accommodate such a wide range. We've done the hard work and compiled this guide with everything you need to know about dropshipping and the best dropshipping suppliers to work with. Top Dropshipping Companies · Route · Shopify · Spocket · Printful · Printify · SaleHoo · AliExpress · Doba Inc. Spocket – best for all beginners; Printful – best for corporate giveaways; Salehoo – best for toys; Printify – best for personalized gifts; AliExpress – best. Top 15 Dropshipping Suppliers for Starting an Online Business · 1. Printify (Print on Demand) · 2. AliExpress (Dropshipping) · 3. Alibaba (Dropshipping) · 4. AliExpress, Walmart, Target, and eBay are some of the best US dropshipping suppliers. Similarly, Etsy, Sam's Club, Pure Formulas, and Shein are also notable. Provides access to over a million products from over suppliers, with an integrated system that works with most major e-commerce marketplaces. You can browse. Looking for the best dropshipping suppliers for ? Discover the top 10 suppliers to kickstart your business, from SaleHoo to, Modalyst to Printful. Looking for the best wholesale drop shipping companies? We've got you Learn how to start your own successful eCommerce business with this free mini. Doba is one of the most popular dropshipping services on the market today. Its popularity is largely due to the fact that it can accommodate such a wide range. We've done the hard work and compiled this guide with everything you need to know about dropshipping and the best dropshipping suppliers to work with. Top Dropshipping Companies · Route · Shopify · Spocket · Printful · Printify · SaleHoo · AliExpress · Doba Inc. Spocket – best for all beginners; Printful – best for corporate giveaways; Salehoo – best for toys; Printify – best for personalized gifts; AliExpress – best. Top 15 Dropshipping Suppliers for Starting an Online Business · 1. Printify (Print on Demand) · 2. AliExpress (Dropshipping) · 3. Alibaba (Dropshipping) · 4.

10 Best Dropshipping Platforms · 1. DSers · 2. AliExpress · 3. SaleHoo · 4. Spocket · 5. Wholesale2B · 6. Doba · 7. Modalyst · 8. Inventory Source. All Dropshipping Consultants ; Twaer GmbH · (8 reviews). Werbeagentur Wien – Branding, Development, E-Commerce, Marketing & UX/UI design ; Webfluencer · (28 reviews). 10 Best Dropshipping Platforms · 1. DSers · 2. AliExpress · 3. SaleHoo · 4. Spocket · 5. Wholesale2B · 6. Doba · 7. Modalyst · 8. Inventory Source. Get the best-selling dropshipping products for your online store at one place. Cheap wholesale products from Selected Suppliers for resale. Which US-based supplier (for branded dropshipping) is the best? · Spocket · Inventory Source · WholeSale2B · SaleHoo · SunRise WholeSale · US Direct. Etail is a software designed to manage multiple marketplaces and suppliers from a single console, offering customized ecommerce solutions and order processing. Be Activewear, an Australian-owned business, is now known as one of the best Shopify dropshipping stores with products in sportswear from more than 60 major. The ecommerce platform that you use is ultimately your dropshipping business's “home” online. Some of the most popular platforms for dropshipping include. Sprocket is rated as one of the best platforms for finding dropshipping suppliers in North America, Europe, and several other regions. Thanks to this. Best dropshippers for small business · Oberlo.: Best overall dropshipper · Doba.: Most versatile · Spocket.: Best budget option · Worldwide Brands.: Best for. Check out our list of the most popular drop shipping wholesale suppliers directories from USA, UK, China and more! Including top free dropshipping. Doba is one of the most popular dropshipping services on the market today. Its popularity is largely due to the fact that it can accommodate such a wide range. Zendrop is a dropshipping supplier that was primarily built for AliExpress dropshipping but now offers lots of US-based products. In the past, Zendrop had a bit. Sprocket is rated as one of the best platforms for finding dropshipping suppliers in North America, Europe, and several other regions. Thanks to this. This is a great dropshipping supplier that also operates in Europe. Spocket has suppliers both in the US and in Europe. This eCommerce platform integrates with. Without a doubt, Doba tops the list of best dropshipping companies out there because of the convenience it offers to e-commerce merchants. Explore every way you can use PageFly to create a stunning online store. Academy. Your go-to guide to create a successful eCommerce business. Shopify. Top Dropshipping Companies · Importify · Spocket · SaleHoo · Doba · Worldwide Brands · Oberlo · Inventory Source · Printify. Best dropshippers for small business · Oberlo.: Best overall dropshipper · Doba.: Most versatile · Spocket.: Best budget option · Worldwide Brands.: Best for. To find US-based dropshipping suppliers for your Shopify store, you can use platforms like Spocket, Modalyst, and Wholesale2B. These services.

Best Car Insurance Companies In Massachusetts

The average cost of car insurance in Massachusetts is $1, in according to marselblog.ru That's 12% lower than the national average. Of course, your. What is the average cost of car insurance in Massachusetts? Massachusetts drivers paid an average of $1, a year for full coverage (liability, collision and. The only companies that stand out as reputable and not slimy are safety, Plymouth Rock and quincy mutual. Most insurance companies have 2 faces. Plymouth Rock explains the process of finding the best car insurance in MA and what to do to get the best coverage at the best price. The average car insurance cost in Massachusetts is $1, for full coverage and $ for minimum coverage per year. · Massachusetts average car insurance rates. Amica is the best homeowners insurance company in Massachusetts, based on our research, with a score of out of 5. State Farm and Geico have the overall cheapest car insurance in Massachusetts for good drivers, based on the companies in our analysis. The Cheapest Car. USAA is the most affordable car insurance company in Massachusetts, while GEICO is the cheapest company for drivers not affiliated with the military · USAA also. Understand all your options before purchasing auto insurance. Shopping for auto insurance can be confusing. Below are steps to help you through this process. The average cost of car insurance in Massachusetts is $1, in according to marselblog.ru That's 12% lower than the national average. Of course, your. What is the average cost of car insurance in Massachusetts? Massachusetts drivers paid an average of $1, a year for full coverage (liability, collision and. The only companies that stand out as reputable and not slimy are safety, Plymouth Rock and quincy mutual. Most insurance companies have 2 faces. Plymouth Rock explains the process of finding the best car insurance in MA and what to do to get the best coverage at the best price. The average car insurance cost in Massachusetts is $1, for full coverage and $ for minimum coverage per year. · Massachusetts average car insurance rates. Amica is the best homeowners insurance company in Massachusetts, based on our research, with a score of out of 5. State Farm and Geico have the overall cheapest car insurance in Massachusetts for good drivers, based on the companies in our analysis. The Cheapest Car. USAA is the most affordable car insurance company in Massachusetts, while GEICO is the cheapest company for drivers not affiliated with the military · USAA also. Understand all your options before purchasing auto insurance. Shopping for auto insurance can be confusing. Below are steps to help you through this process.

Allstate is a fan favorite in Massachusetts, with the average full coverage policy costing about $1, annually. This insurer offers competitive rates for all. For a current list of all insurance companies offering auto insurance in Massachusetts quotes from different insurance companies in order to find the best. These companies range from those with a local presence, like Safety Insurance, to national players. They offer diverse policies that include vehicle, home. The Hanover Insurance Group, Inc., based in Worcester, Mass., is the holding company for several property and casualty insurance companies, which together. Car Insurance Companies in Massachusetts · 1. MAPFRE Insurance, % · 2. GEICO (Government Employees Insurance Co), % · 3. Liberty Mutual Insurance Co, %. Let's break it down into a few key guidelines: Car insurance rates are very individualized, based on you (the buyer) and your profile. Massachusetts drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. The best car insurance companies in Massachusetts ; 1st place medal. USAA ; 2nd place medal. Amica Insurance ; 3rd place medal. State Farm. Best and Cheapest Car Insurance in Massachusetts (Earn Savings With These 10 Companies in ) · USAA: Top Overall Pick · Geico: Best for Many Discounts · State. Cheapest Car Insurance in Massachusetts · Plymouth Rock, Geico, USAA, Progressive and Farmers are among the cheapest car insurance companies in Massachusetts. MA auto insurance is underwritten by Plymouth Rock Assurance Corporation. MA home insurance is underwritten by Plymouth Rock Home Assurance Corporation, Bunker. The best high-risk auto insurance companies in Massachusetts are State Farm, USAA, and Geico because they offer the most competitive rates for high-risk drivers. GEICO, USAA, and State Farm offer some of the most competitive rates for auto insurance policies in Massachusetts, but it's recommended to shop around and. Safety is the cheapest car insurance company in Massachusetts overall, with an average rate of $43 per month for minimum coverage and $ per month for full. Comparing quotes from multiple companies is the best way to find the cheapest rates for you, but Safeco is the cheapest car insurance company in Massachusetts. GEICO, USAA, and State Farm offer some of the most competitive rates for auto insurance policies in Massachusetts, but it's recommended to shop around and. Offers a wide range of insurance solutions for homes and vehicles. · Is the 23rd largest Property-Casualty insurer. · Is the 19th largest private passenger auto. The #1 car insurance company is State Farm because it is the largest auto insurer in the U.S., with a market share of 16%. State Farm insures over 80 million. Allstate is a fan favorite in Massachusetts, with the average full coverage policy costing about $1, annually. This insurer offers competitive rates for all.

My Depression Comes In Waves

This fact sheet provides information about seasonal affective disorder (SAD), a type of depression. It includes a description of SAD, signs and symptoms. Laziness is a symptom of something bigger, such as depression or anxiety. If you're feeling lazy you typically procrastinate on important tasks, feel tired. A depressive episode may have more extreme symptoms than typical periods of low mood. People can try to make changes to their thoughts and behaviors and. Post-vacation depression, also known as holiday blues, is that dread, sadness or anxiety that you can start to feel at the end of your trip or when you get. It's actually very, very normal for clinical depression to come in waves. Those waves are called “depressive episodes,” and there is actually a. What are some different types of depression? · Major Depression · Bipolar Disorder · Persistent Depression (PD) · Seasonal Affective Disorder (SAD) · Depressive. While persistent depressive disorder is not as severe as major depression, your current depressed mood could range from mild to moderate or severe. As. Atypical depression is a type of depression in which the symptoms stray from the traditional criteria. Symptoms include mood reactivity, hypersomnia and. One of the common misunderstandings about depression is that it is similar to feeling sad or down. Although many people with depression feel sadness. This fact sheet provides information about seasonal affective disorder (SAD), a type of depression. It includes a description of SAD, signs and symptoms. Laziness is a symptom of something bigger, such as depression or anxiety. If you're feeling lazy you typically procrastinate on important tasks, feel tired. A depressive episode may have more extreme symptoms than typical periods of low mood. People can try to make changes to their thoughts and behaviors and. Post-vacation depression, also known as holiday blues, is that dread, sadness or anxiety that you can start to feel at the end of your trip or when you get. It's actually very, very normal for clinical depression to come in waves. Those waves are called “depressive episodes,” and there is actually a. What are some different types of depression? · Major Depression · Bipolar Disorder · Persistent Depression (PD) · Seasonal Affective Disorder (SAD) · Depressive. While persistent depressive disorder is not as severe as major depression, your current depressed mood could range from mild to moderate or severe. As. Atypical depression is a type of depression in which the symptoms stray from the traditional criteria. Symptoms include mood reactivity, hypersomnia and. One of the common misunderstandings about depression is that it is similar to feeling sad or down. Although many people with depression feel sadness.

Depression can develop out of the blue with no reason as to why you are feeling depressed. There are things you can do to improve how you are feeling despite. Depression is regarded as a disorder when low mood and other symptoms persist for more than two weeks. Mood dysregulation revealed by unrelenting sadness may be. Normal Brain. Depression is a widely occurring mental health condition, identified by sustained sentiments of sorrow, apathy, and various physical symptoms. Explore the Facets of Depression, a Mood Disorder Causing Sadness & Hopelessness. Discover How It Comes in Waves & Seek Professional Help to Manage It. It's actually very, very normal for clinical depression to come in waves. Those waves are called “depressive episodes,” and there is actually a. While persistent depressive disorder is not as severe as major depression, your current depressed mood could range from mild to moderate or severe. As. Melancholia is a type of depression, sometimes referred to as melancholic depression. Read more about the symptoms, diagnosis and treatment here. 72 Likes, TikTok video from Akai Alexander (@marselblog.ruderrr): “Depression comes in waves. It can be disguised as a smile. Infection, immune dysfunction and neuroinflammation have all been implicated in chronic mental disorders such as major depressive disorder, anxiety. Perimenopausal Depression, Premenstrual Syndrome (PMS), and Premenstrual Dysphoric Disorder (PMDD) are menstrually-related mood disorders treated in our. While my bipolar diagnosis initially brought relief — a dawning of truth explaining what I'd endured for so long — as soon as depression moved in I started to. Feeling sad is a normal reaction to difficult times in life. Depression is different—it is a mood disorder that can affect how a person feels, thinks. The so-called “change of life” comes with a host of symptoms triggered by hormonal shifts — hot flashes, insomnia, mood fluctuations and even depression. Signs of depression and the progression of this mental health condition can vary from person to person, but there are some symptoms you should not ignore. Signs of depression and the progression of this mental health condition can vary from person to person, but there are some symptoms you should not ignore. Depression (major depressive disorder) is a common and serious medical illness that negatively affects how you feel, the way you think and how you act. Depression - Learn about the causes, symptoms, diagnosis & treatment from the MSD Manuals - Medical Consumer Version. Millions of men have erectile dysfunction, and more than a quarter of American adults suffer from depression or another mental health disorder. Major depressive disorder (MDD), also known as clinical depression, is a mental disorder characterized by at least two weeks of pervasive low mood. Looking for an at-home, non-invasive depression treatment? Flow treats your symptoms with a brain stimulation headset and virtual behaviour therapy.

Performance Fee Hedge Fund

The simplest means of accounting for Performance Fees is to treat the. Fund itself as the client and ignore the individual investment experience of investors. Incentive fees are calculated on gross gains and not gains net of management fees. The performance of the hedge fund is provided below. Calculate the total fees. The 20% performance fee is the biggest source of income for hedge funds. The performance fee is only charged when the fund's profits exceed a prior agreed-upon. The incentive fee is a performance based fee that is a fund's claim on a portion of the total profits of the investments. Additionally, many hedge funds. This is usually taxed to the Hedge Fund as Ordinary Income. 20% Performance Fee (Carried Interest). Conversely, the performance fees are based. The common fee structure is “2 and 20,” representing a 2% management fee and a 20% incentive fee. Additionally, funds of hedge funds typically charge a “1 and. A performance fee in a hedge fund also represents an economic benefit that accrues to the manager. Performance fees are generally 20% of fund returns, but may. The performance fee is generally around twenty percent of the increase in value over a specified period of time, although some larger management firms have. The average fund currently charges a management fee of % and 17% performance fee, compared with % and 20% 10 years ago. Hedge fund managers are also. The simplest means of accounting for Performance Fees is to treat the. Fund itself as the client and ignore the individual investment experience of investors. Incentive fees are calculated on gross gains and not gains net of management fees. The performance of the hedge fund is provided below. Calculate the total fees. The 20% performance fee is the biggest source of income for hedge funds. The performance fee is only charged when the fund's profits exceed a prior agreed-upon. The incentive fee is a performance based fee that is a fund's claim on a portion of the total profits of the investments. Additionally, many hedge funds. This is usually taxed to the Hedge Fund as Ordinary Income. 20% Performance Fee (Carried Interest). Conversely, the performance fees are based. The common fee structure is “2 and 20,” representing a 2% management fee and a 20% incentive fee. Additionally, funds of hedge funds typically charge a “1 and. A performance fee in a hedge fund also represents an economic benefit that accrues to the manager. Performance fees are generally 20% of fund returns, but may. The performance fee is generally around twenty percent of the increase in value over a specified period of time, although some larger management firms have. The average fund currently charges a management fee of % and 17% performance fee, compared with % and 20% 10 years ago. Hedge fund managers are also.

Performance fees are typically set at 20% of the fund's profits.

a performance fee: a percentage of the fund's NAV increase, often in a range of 10 to 50%. Sometimes, the latter is subject to a 'high water mark' which is a. The investment management fee is generally 1% to 2% of AUM. Although the typical fund offering provides for a management fee paid to the manager periodically . This means that, regardless of how high the return, you will pay the performance fee – for example, 20 percent – on the portion above the hurdle. What happens. FOHFs impose management and performance fees that are in addition to the fees imposed by the underlying hedge funds in which the FOHFs invest. Some FOHFs are. A typical, reputable third-party marketer will take 20% of the management and performance fees, plus often a retainer, while many wealth managers/distribution. Than Stated Fee. HEDGE FUND MANAGEMENT FEES. HEDGE FUND PERFORMANCE FEES. Page 5. EVESTMENT STATE OF INSTITUTIONAL FEES REPORT: HEDGE FUNDS | 5. Negotiated. Hedge funds charging a 1% management fee accounted for 63% of the total for equity L/S funds commencing between and , while nine years later, between. Example 3 · Some funds involve a performance fee. · The GAV, or sometimes called the G-NAV, is the fund value before performance fees have been charged but. For hedge fund managers that are registered as investment advisors with the SEC, there is a simple rule regarding performance fees – performance based fees can. For example, if a commodity pool has $1 million in AUM and earns a profit of $,, the performance fee would amount to $40, (20% of the $, profit). The once standard practice of charging investors a 2% management fee and a 20% performance fee on hedge fund net profits is being replaced by a raft of. Performance fees are widely used by the investment managers of hedge funds, which typically charge a performance fee of 20% of the increase in the NAV of the. HWM is a specified Net Asset Value (NAV) level that a fund must exceed before Performance Fees are paid to the hedge fund manager. Once the first incentive. This fee is typically set at 20% of the profits generated by the fund above its high water mark. High Water Mark: The high water mark is a. The average fees charged by a fund with over $5bn in assets under management is a percent management fee and percent performance fee, compared with. The asset management fee is generally between 1% and 2% of the fund's net assets, and is typically charged on a monthly or quarterly basis. The performance fee. The standard performance fee in the hedge fund is 20% of investment profit. As an example, if a fund has a profit of $1 million over the course. Option for an asset management fee (applies to beginning NAV each period) and happens no matter what the performance is. This fee is reduced from any gains/. Hedge fund fees are usually two-fold: management fees and incentive fees. For example, a “2 and 20” fee structure bills a client 2% of funds under management as. This is paid irrespective of how the fund performs. The hedge fund managers also charge an incentive fee of 20% of profits. The fee charged is mentioned as “2.

How Do You Say I Speak German In German

Let's start simple: Ich spreche Deutsch means "I speak German." When saying “Ich spreche Deutsch” correctly, it is important to remember the proper. How to say "How many languages do you speak?" in German (Wieviele Sprachen sprichst du?). And how you can say it just like a native. How do you say. I speak German in German? ich spreche Deutsch. Hear how a local says it. Arrow image. Hear how a local says it. Arrow image. German is among the ten most commonly spoken languages in the world. It is also a lingua franca of Central and Eastern Europe. And as for “all Germans speak. German is among the ten most commonly spoken languages in the world. It is also a lingua franca of Central and Eastern Europe. And as for “all Germans speak. Translation for 'i speak english' in the free English-German dictionary and many other German translations. In German, "I only speak a little German" can be translated as "Ich spreche nur ein wenig Deutsch". Discover how to speak German fluently · 1. Find your motivation. Whenever you feel like giving up, remember why you are doing this. · 2. Learn using your senses. "Ich spreche Deutsch" is "I speak German" or "I'm speaking German", which is often the act of actively speaking it, but it can also be used. Let's start simple: Ich spreche Deutsch means "I speak German." When saying “Ich spreche Deutsch” correctly, it is important to remember the proper. How to say "How many languages do you speak?" in German (Wieviele Sprachen sprichst du?). And how you can say it just like a native. How do you say. I speak German in German? ich spreche Deutsch. Hear how a local says it. Arrow image. Hear how a local says it. Arrow image. German is among the ten most commonly spoken languages in the world. It is also a lingua franca of Central and Eastern Europe. And as for “all Germans speak. German is among the ten most commonly spoken languages in the world. It is also a lingua franca of Central and Eastern Europe. And as for “all Germans speak. Translation for 'i speak english' in the free English-German dictionary and many other German translations. In German, "I only speak a little German" can be translated as "Ich spreche nur ein wenig Deutsch". Discover how to speak German fluently · 1. Find your motivation. Whenever you feel like giving up, remember why you are doing this. · 2. Learn using your senses. "Ich spreche Deutsch" is "I speak German" or "I'm speaking German", which is often the act of actively speaking it, but it can also be used.

When you speak, you use your voice in order to say something. He tried to speak, but she interrupted him. American English: speak /ˈspik/; Arabic. Say, do you speak German? Dis donc, tu parles l'allemand. Do you speak German? Tu parles l'allemand? Do you speak German by any chance? Vous parlez allemand. speak German even if you have no German speakers around you Many conversations (at a basic level) are quite predictable: say, people will ask you why you are. German is the official language of Germany and Austria. Nearly million people speak it as their first language, and an additional million speak it as. "Sprechen Sie Deutsch?", with "Sie" capitalized, is taken to mean "Do you speak German?", so it's not ambiguous in writing, but could. When in Germany, Do as Germans Do - Speak German! There are numerous layers of importance when it comes to speaking the German language when travelling to. German is the official language of Germany and Austria. Nearly million people speak it as their first language, and an additional million speak it as. Answer to: How do you say do you speak German in German? By signing up, you'll get thousands of step-by-step solutions to your homework questions. German is spoken by millions of people, not only in Germany, but in Austria, Switzerland, Belgium, Liechtenstein, Luxembourg, and many other places around. Translate I speak german. See Spanish-English translations with audio pronunciations, examples, and word-by-word explanations. What is the translation of "Do you speak German?" in German? Sprechen Sie Deutsch? chevron_left. Translations Translator Phrasebook open_in_new. chevron_right. The verb “sprechen” to speak will be one you are likely to use frequently, especially when you've just started learning German. Sprechen Sie Deutsch? - (Shpre-khen zee doytsh) Formal for "Do you speak German?" Sprichst du Deutsch? - (Shprisht doo doytsh) Informal for "Do you speak. Say “ja” to German fluency today! · 4. Turn up the volume · 5. Record yourself · 6. Create a personal phrasebook · 7. Speak up. Start learning German quickly and effectively with Mondly's free daily lessons! In just minutes you'll start memorizing core German words, form sentences. It is the most spoken native language within the European Union. It is the most widely spoken and official (or co-official) language in Germany, Austria. GERMAN AUTOMATICALLY. SPEAK GERMAN NOW · GERMAN FOR BEGINNERS - 50 PHRASES - HOW WOULD YOU SAY THIS IN GERMAN? - TEST. SPEAK GERMAN NOW. When in Germany, Do as Germans Do - Speak German! There are numerous layers of importance when it comes to speaking the German language when travelling to. To help you master this language, consider some of the following tips on how to speak with German accent pronunciation. pronounce German words. This is. Do you speak German? (English) = Sprechen Sie Deutsch? (German).