marselblog.ru News

News

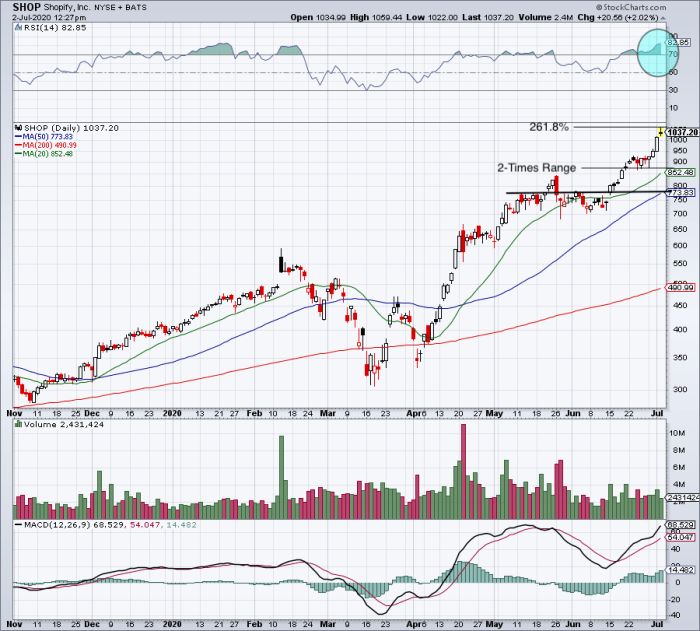

Shopify Insider Trading

Insiders have sold a total of , Shopify shares in the last 24 months for a total of C$11,, sold. Shopify Inc. Cl A company facts, information Transaction Summary. Total Insider Purchases and Sales Reported to the SEC. Timeframe, Transactions, Shares. Shopify Inc. Class A Subordinate Voting Shares (SHOP) An insider trading activity happens when corporate insiders trade in stock in their own companies. SEC Form 4 Insider Trading Screener. Monitor SEC Form 4 Insider Trading Filings for Insider Buying and Selling. Real-time Insider Trading Stock Screener. Get the latest stock price for Shopify Inc. Class A Subordinate Voting Shares (SHOP), plus the latest news, recent trades, charting, insider activity. Insider-Trading-Informationen für NDAQ werden aus den Formularen 3 und 4 abgeleitet, die bei der U.S. Securities and Exchange Commission (SEC) eingereicht. Shopify (SHOP) insider trading. Corporate insiders Sold shares worth $M in the last 3 months. See the highest value insider transactions. Shopify Inc. (T:SHOP). . Insider Chart Past 6 Months. Show only public market trades. SHOP, D. On/aHn/aLn/aCn/a. Compare. INK Edge Outlook. Get the latest insider transactions for Shopify Inc. (marselblog.ru). Find out the total of insider shares held, purchased and sold. Insiders have sold a total of , Shopify shares in the last 24 months for a total of C$11,, sold. Shopify Inc. Cl A company facts, information Transaction Summary. Total Insider Purchases and Sales Reported to the SEC. Timeframe, Transactions, Shares. Shopify Inc. Class A Subordinate Voting Shares (SHOP) An insider trading activity happens when corporate insiders trade in stock in their own companies. SEC Form 4 Insider Trading Screener. Monitor SEC Form 4 Insider Trading Filings for Insider Buying and Selling. Real-time Insider Trading Stock Screener. Get the latest stock price for Shopify Inc. Class A Subordinate Voting Shares (SHOP), plus the latest news, recent trades, charting, insider activity. Insider-Trading-Informationen für NDAQ werden aus den Formularen 3 und 4 abgeleitet, die bei der U.S. Securities and Exchange Commission (SEC) eingereicht. Shopify (SHOP) insider trading. Corporate insiders Sold shares worth $M in the last 3 months. See the highest value insider transactions. Shopify Inc. (T:SHOP). . Insider Chart Past 6 Months. Show only public market trades. SHOP, D. On/aHn/aLn/aCn/a. Compare. INK Edge Outlook. Get the latest insider transactions for Shopify Inc. (marselblog.ru). Find out the total of insider shares held, purchased and sold.

The latest insider stock transactions for Shopify Inc (SHOP).

The 90 analysts offering price forecasts for Shopify have a median target of , with a high estimate of and a low estimate of Preventing unlawful insider trading: disclosure and trading guidelines · 1. Transactions involving the Company's securities are prohibited at all times if you. Accessibly App is an app supported in Shopify and Wordpress environments. Only investing in stocks with insider buying; Concentrated approach: focus on. SHOP stock data, price, and news. View SHOP insider trading, corporate lobbying, Congressional trading, social media sentiment, and more. Uncover the latest insider trading activity for Shopify Inc. (SHOP). Know which insiders are buying and selling along with top shareholders and ownership. View a financial market summary for SHOP including stock price quote, trading volume, volatility, options volume, statistics, and other important company. Based on ownership reports from SEC filings, as the reporting owner, Shopify Inc. owns 2 companies in total, including Affirm Holdings Inc (AFRM), and Klaviyo. Shopify Inc. insider trades are shown in the following chart. Insiders are officers, directors, or significant investors in a company. In general, it is. Shopify Stock Ownership Analysis · Shopify Stock Institutional Investors · Shopify Insider Trading Activities · Shopify's latest congressional trading · Shopify. SHOP: Shopify - Insider Transactions Get the latest Insider Transactions for Shopify from Zacks Investment Research. Find out the latest and most up-to-date insider trades for Shopify Inc (SHOP) at marselblog.ru Insiders are prohibited from making short-swing profits by trading their shares within 6 months of the registration or acquiring the shares. Shares are not. The Last 12 Months Of Insider Transactions At Shopify. The Director, Toby Shannan, made the biggest insider sale in the last 12 months. That single transaction. Shopify Inc. (SHOP) latest news, insider trading and hedge fund ownership data provided by Insider Monkey. Understanding Insider Activity at SHOPIFY INC. Welcome to our dedicated page for SHOPIFY INC. (NYSE: SHOP) insider trading activity, sourced directly from. Shopify Inc (marselblog.ru) (%) 07/17/24 [TSX] x x Realtime by. Uncover the latest insider trading activity for Shopify Inc. (SHOP N). Know which insiders are buying and selling along with top shareholders and ownership. Insiders are positive buying more shares than they are selling in Shopify. In the last 58 trades there were million shares bought and million shares. Jeff Hoffmeister, Senior Officer at Shopify (SHOP), has a % success rate when buying and selling stocks. Trading Data · Insider Trading Data · SEC Filings · Stock Screener. Explore. Workbench · Portfolio Builder · Insider Overview · Global Dividends · Sample.

Red River Bank Mobile Deposit Funds Availability

Deposits made after 4pm will post the following business day between 8am - 9am. Deposits made on Friday after 4pm through Monday morning prior to 8am will post. The I Connect/E Connect Savings account earns an above-average APY, requires no minimum deposit to open, and charges no monthly fees. The bank also offers the I. With Red River Bank RED, it's possible to achieve as much as a 95% next-day availability on items drawn on banks outside of our Federal Reserve District. Deposit checks - Pay bills - Transfer funds - Send and receive secu You Might Also Like. See All · MyFarmers Mobile. Finance. Red River Bank Mobile-RRB. Mobile Deposit. If you need to deposit a check and do not want to make a special trip to the bank, our mobile deposit service makes depositing funds into. Items submitted after PM Central Time or on a non‐ Business Day will be deposited within 2 Business Days. Funds deposited using Mobile Deposit will be made. Funds Availability · Local check - All U.S. (non-foreign) checks payabe to you that are not listed with "Next Day Availability" · State or local government check. You may deposit up to $2, per day using mobile deposit, and all checks are processed each business day by 4pm. Any deposits submitted before 4pm will be. Never deposited a check with your phone? Here's how, in a few easy steps. Deposits made after 4pm will post the following business day between 8am - 9am. Deposits made on Friday after 4pm through Monday morning prior to 8am will post. The I Connect/E Connect Savings account earns an above-average APY, requires no minimum deposit to open, and charges no monthly fees. The bank also offers the I. With Red River Bank RED, it's possible to achieve as much as a 95% next-day availability on items drawn on banks outside of our Federal Reserve District. Deposit checks - Pay bills - Transfer funds - Send and receive secu You Might Also Like. See All · MyFarmers Mobile. Finance. Red River Bank Mobile-RRB. Mobile Deposit. If you need to deposit a check and do not want to make a special trip to the bank, our mobile deposit service makes depositing funds into. Items submitted after PM Central Time or on a non‐ Business Day will be deposited within 2 Business Days. Funds deposited using Mobile Deposit will be made. Funds Availability · Local check - All U.S. (non-foreign) checks payabe to you that are not listed with "Next Day Availability" · State or local government check. You may deposit up to $2, per day using mobile deposit, and all checks are processed each business day by 4pm. Any deposits submitted before 4pm will be. Never deposited a check with your phone? Here's how, in a few easy steps.

Check balances, make payments and transfer funds by phone. Call toll free or Bank 24 hours a day, 7 days a week from any phone. FREE ONLINE BANKING. Get easy access to your account from your PC, laptop or mobile phone. FREE E-STATEMENT. Access your statements at your convenience. Planters Bank Mobile Banking; Platinum Federal Credit Union; Platte Valley Bank NE; Platte Valley Bank WY Red River Bank; Red Rock Bank; Red Wing Credit Union. Discover the benefits of our range of banking services as you access important information and perform common tasks with ease, simplifying your financial life. Funds from deposits of checks drawn on Red River State Bank will be available on the same business day as the day of your deposit. Funds from all other check. Get our Mobile Banking app for iPhone, iPad and Android! VIEW ALL PERSONAL PRODUCTS. for your. Business. Working Capital, Loans, Business Checking & more». Access your account 24/7, plus take advantage of features that make life easier like instant check deposit, automated payments or transfers. Online Banking. Frequently asked questions. We offer great mobile banking technology and apps. A great range of mortgage loan options. And, we figure, all those offerings. State Bank of Dekalb Overdraft Protection. CHIP Card is here. Mobile Banking Now Available visit the app store and enjoy access to your accounts anywhere you. funds deposited by check in any receiving depository institution in the case of— (C) banks insured by the Federal Deposit Insurance Corporation (other. With this feature in our Mobile Banking App, depositing checks on an iPad, iPhone, or Android phone & tablet is easier than ever—from anywhere, on your time! This service is available for eligible* RRCU members who are enrolled in Online Banking. Checks can be deposited into your RRCU Checking, Savings, or Money. ATM service. With a Red River Bank ATM card, 24 hour banking is at your fingertips. Withdraw cash, check your balance, transfer funds between your accounts, and. Pending indicates your check has been submitted but has not been accepted by the bank yet. Rejected indicates your check was rejected due to quality, duplicate. Mobile banking, FREE, FREE, FREE, FREE, FREE, Available. Bill Pay, FREE, FREE, FREE Free automatic funds transfers to any RRB account. Four (4) free cashier's. We are a community bank that has grown to be $ billion strong because we remember our hometowns and that everyone's needs are different and constantly. Personal Touch 24 is Red River Bank's hour telephone banking service. At any hour of the day, from the comfort of your home or from any touch-tone telephone. Deposits processed by PM ET on a business day will be available the next business day. For deposits made after PM ET, funds will be available the. Our policy is to make funds from your cash and check deposits available to you on the first business day after the day we receive your deposit. Electronic. Quickly deliver funds availability through your existing mobile and ATM channels, and in-person at the teller window.

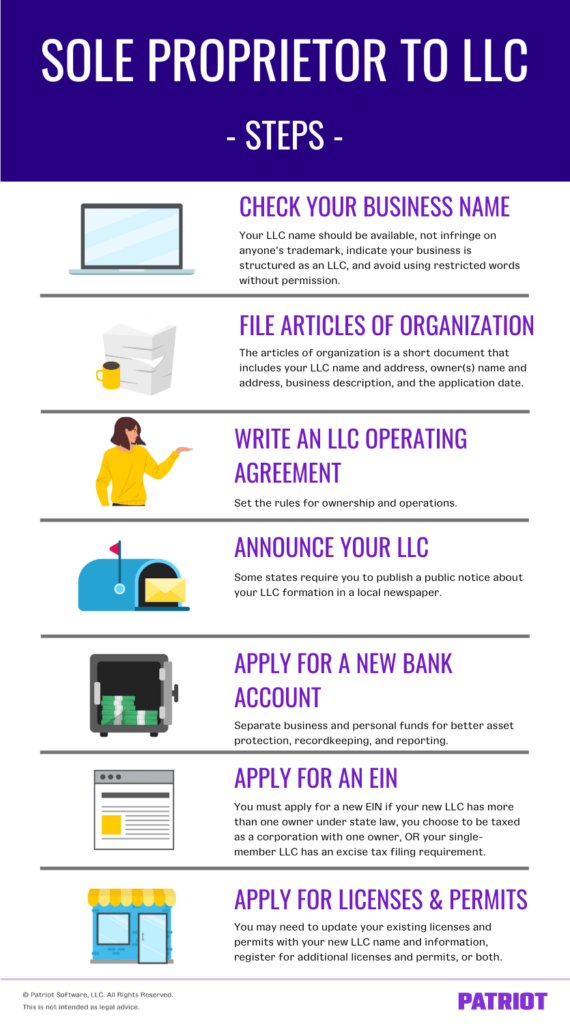

Changing Business From Sole Proprietor To Llc

In this list go down and open the “Certificate of Organization (DSCB)” under the “Domestic Limited Liability Company” heading. First, you will complete. If you are a sole proprietorship, you can become a corporation or LLC, but it is not considered a conversion. You need to incorporate your business as a. The process to change a business structure (for example, change from a sole proprietorship to a corporation) is the same as starting a new business. #1 Obtain an Articles of Organization Form from the State Where You Plan to Establish Your LLC · #2 Select a Business Name · #3 Complete the Articles of. The IRS doesn't require single-member LLC owners to get a separate EIN because they're not employees of the LLC. So, when you move from a sole proprietorship to. If your business changes and you want to bring in another owner, you'll need to register for an EIN (Employer Identification Number). By bringing in another. Sole proprietors · You change the name of your business. · You change your location and/or add other locations. · You operate multiple businesses. How to Change Your LLC to a Sole Proprietorship · 1. Get Approval from All LLC Members · 2. File Your Dissolution Documents. If it is a single owner LLC, you can simply form the LLC using the provider of your choice, and use the same federal EIN. Your LLC is. In this list go down and open the “Certificate of Organization (DSCB)” under the “Domestic Limited Liability Company” heading. First, you will complete. If you are a sole proprietorship, you can become a corporation or LLC, but it is not considered a conversion. You need to incorporate your business as a. The process to change a business structure (for example, change from a sole proprietorship to a corporation) is the same as starting a new business. #1 Obtain an Articles of Organization Form from the State Where You Plan to Establish Your LLC · #2 Select a Business Name · #3 Complete the Articles of. The IRS doesn't require single-member LLC owners to get a separate EIN because they're not employees of the LLC. So, when you move from a sole proprietorship to. If your business changes and you want to bring in another owner, you'll need to register for an EIN (Employer Identification Number). By bringing in another. Sole proprietors · You change the name of your business. · You change your location and/or add other locations. · You operate multiple businesses. How to Change Your LLC to a Sole Proprietorship · 1. Get Approval from All LLC Members · 2. File Your Dissolution Documents. If it is a single owner LLC, you can simply form the LLC using the provider of your choice, and use the same federal EIN. Your LLC is.

Applying for a new EIN with the IRS The Secretary of State office in your state will let you know if your desired business name is available. You'll also file. You can convert your sole proprietorship to an LLC by filing articles of organization with your state. LLCs offer advantages that sole proprietorships don't. To change from a sole proprietorship to an LLC, also known as a limited liability company, is almost like starting an entirely new business. You might have to. The most common and the simplest form of business is the sole proprietorship. The limited liability company (LLC) is not a partnership or a corporation. If you already have an EIN for your sole proprietorship and decide to upgrade to an LLC, you will generally need to obtain a new EIN for the LLC. If you're a sole proprietor using a DBA, changing your business identity into an LLC will require some legwork. But in exchange, you'll get the limited. The most common and the simplest form of business is the sole proprietorship. The limited liability company (LLC) is not a partnership or a corporation. Business Partnership: To convert a partnership, you must fill out and file the Articles of Organization and pay the filing fee. The business assets should then. Many people who form a single-member limited liability company (SMLLC) already have a business and simply want to change that business's legal form. Hold a meeting and get member approval · Create a dissolution agreement ; Getting a new EIN from the IRS. · Registering a DBA. ; Open a new business bank account. To change a sole proprietorship to an LLC, you'll need to file the necessary formation documents with your state, obtain an EIN (Employer Identification. When you change from a sole proprietorship to an LLC, you must file an article of organization and register your business with your state. An article of. Transitioning to an LLC or S corporation establishes your business as its own distinct legal entity separate from yourself personally. This protects your. It's pretty straightforward to move a sole proprietorship (or partnership) to a new state. You're required to register your new business using the “Doing. It's pretty straightforward to move a sole proprietorship (or partnership) to a new state. You're required to register your new business using the “Doing. sole proprietorships). You should consult your attorney and accountant to Example: LLC taxed as an S Corp changes election to be taxed as a Corporation. A new license is required whenever the business entity changes (such as sole owner to corporation, sole owner to partnership, partnership to corporation, etc.). Transitioning to an LLC or S corporation establishes your business as its own distinct legal entity separate from yourself personally. This protects your. Employer identification number or EIN is required if you are converting your business structure from a sole proprietorship to LLC as outlined by the IRS.

What Is A Delaware Company

Delaware corporations provide small businesses the exact same limited liability afforded to large businesses. A Delaware corporation allows for a separation of. We can provide a Delaware Company Search report from the Division of Corporations which includes details of the company, confirms its existence and lists. One of the main reasons why companies incorporate in Delaware is the legal and liability protection of established corporate laws. Get the fastest Delaware corporation formation online with worry-free services and support to start your business. One of the main reasons why companies incorporate in Delaware is the legal and liability protection of established corporate laws. No Residency Requirement Delaware allows nearly anyone in the world to form an LLC or corporation in their state. They have no residency requirements for. A company that is incorporated in Delaware is generally subject to regulation wherever it does business, and its Delaware charter will not immunize it in any. The cost to form an LLC (limited liability company) or incorporate a business in Delaware is consistently among the lowest in America. Delaware is considered a corporate haven because of its business-friendly corporate laws compared to most other U.S. states. Delaware corporations provide small businesses the exact same limited liability afforded to large businesses. A Delaware corporation allows for a separation of. We can provide a Delaware Company Search report from the Division of Corporations which includes details of the company, confirms its existence and lists. One of the main reasons why companies incorporate in Delaware is the legal and liability protection of established corporate laws. Get the fastest Delaware corporation formation online with worry-free services and support to start your business. One of the main reasons why companies incorporate in Delaware is the legal and liability protection of established corporate laws. No Residency Requirement Delaware allows nearly anyone in the world to form an LLC or corporation in their state. They have no residency requirements for. A company that is incorporated in Delaware is generally subject to regulation wherever it does business, and its Delaware charter will not immunize it in any. The cost to form an LLC (limited liability company) or incorporate a business in Delaware is consistently among the lowest in America. Delaware is considered a corporate haven because of its business-friendly corporate laws compared to most other U.S. states.

We're experienced in forming new LLCs and corporations, document retrieval (ie good standings), and providing registered agent services. In Delaware, limited liability companies (LLCs) are formed by filing a formation document called the Certificate of Formation with the Division of Corporations. What Is a Delaware Corporation? A Delaware corporation is a company that is legally registered in the state of Delaware but may conduct business in any state. A Delaware corporation is a type of legal business entity that provides limited liability protection for its owners and managers. When a business forms as a. The Delaware Division of Corporations answers all of your frequently asked questions about incorporating in Delaware on this page. The Delaware Division of Corporations answers all of your frequently asked questions about incorporating in Delaware on this page. Simply put, a C-corp is a type of corporation formed under Delaware laws. The “C” refers to the company's tax status, not the type of business entity. A. 1. State statutes keep Delaware at the cutting edge of business law. Delaware is home to some of the most business-friendly laws in the country. A Delaware LLC is usually a better option for a smaller business. It's easier to set up, but it still offers you certain advantages you'd get from a corporation. The Delaware General Corporation Law (the “DGCL”) is widely accepted as the gold standard in United States corporate practice. The statute is taught in most law. The Delaware limited liability company (LLC) is a type of business entity created and regulated under the Delaware LLC Act. Delaware incorporation creates a straightforward path for issuing shares. · Delaware's corporate tax system is well established, respected, and business-friendly. 1. Investors Prefer Delaware Corporations · 2. Most Public Companies are Incorporated in Delaware · 3. Corporations Have More Privacy in Delaware · 4. Delaware is. Delaware is the leading jurisdiction for the incorporation of companies in the US. For further information, please visit the government website. Notable firms ; TMI Group of Companies, Industrials, Industrial machinery ; Tritek, Technology, Software ; Twin Lakes Brewing Company, Consumer goods, Brewers. Benefits of incorporating in Delaware · Does not collect corporate taxes from companies formed in Delaware when they do not conduct business in the state · Does. Incorporation is fast and simple. This state offers attractive tax regulations, innovative corporate laws and the existence of a chancery court system. This article will explore the pros and cons of incorporating in Delaware, highlight popular companies incorporated in the state, and provide key information. We are experienced, friendly, and reasonably priced. You can form a Delaware corporation or limited liability company online, by phone, by fax, or by mail. Delaware permits you to be a one person Corporation or one member LLC. The Delaware corporate franchise tax is minimal and quite competitive with other states .

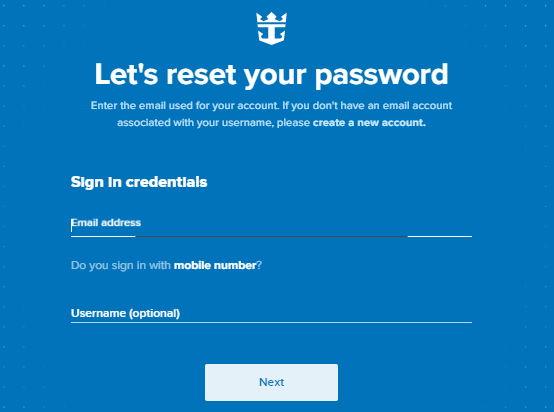

Royal Caribbean Create Account

Log in using the fields below. Or, if you don't have a My Cruises account, create one now. Have an account for our mobile app? Soon. Explore cruises – from Europe to Alaska, the Caribbean to Asia – and book with just a few taps. Tackle all your travel planning, too. To create a My Cruises account now, fill in the fields below and create a password that contains a minimum of 8 characters. Must include at least one uppercase. Royal Caribbean Cruises Ltd. is an equal opportunity employer. All applicants are considered without regard to race, color, religion, national origin, sex or. We will receive an email once you've completed your registration and will activate your account within 24hrs. or less. Commission. to Royal Caribbean University! · CREATE A USERNAME. Keep a note of your Username, you'll need this to sign in later · FIRST NAME · LAST NAME · EMAIL · EMPLOYEE ID. Create Account · Are you at least 18 years of age? · Got sea legs? Please let us know if you've worked on board ships before.: · Have you ever been part of our. Royal Caribbean International 4+. Make the most of your cruise. Royal Caribbean Cruises Ltd. #29 in Travel. • K Ratings. Free. iPhone Screenshots. You can create a Guest Account at any time; however, we recommend that you create an account prior to your cruise so you can plan your vacation and use the app. Log in using the fields below. Or, if you don't have a My Cruises account, create one now. Have an account for our mobile app? Soon. Explore cruises – from Europe to Alaska, the Caribbean to Asia – and book with just a few taps. Tackle all your travel planning, too. To create a My Cruises account now, fill in the fields below and create a password that contains a minimum of 8 characters. Must include at least one uppercase. Royal Caribbean Cruises Ltd. is an equal opportunity employer. All applicants are considered without regard to race, color, religion, national origin, sex or. We will receive an email once you've completed your registration and will activate your account within 24hrs. or less. Commission. to Royal Caribbean University! · CREATE A USERNAME. Keep a note of your Username, you'll need this to sign in later · FIRST NAME · LAST NAME · EMAIL · EMPLOYEE ID. Create Account · Are you at least 18 years of age? · Got sea legs? Please let us know if you've worked on board ships before.: · Have you ever been part of our. Royal Caribbean International 4+. Make the most of your cruise. Royal Caribbean Cruises Ltd. #29 in Travel. • K Ratings. Free. iPhone Screenshots. You can create a Guest Account at any time; however, we recommend that you create an account prior to your cruise so you can plan your vacation and use the app.

My Account · Cruise Planner · My Booking · Make a Payment · Check-In for My Royal Caribbean Beverage Package Water. Visit marselblog.ru If you have an existing account simply sign in and link your cruise. · If you are new to sailing with Royal Caribbean Cruise. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO® Score available. The feature is. Why are Hard Rock International, Seminole Gaming, Royal Caribbean International and Celebrity Cruises, creating a partnership? Create Account · Complete. Creating an account has many benefits: See order and shipping status; Track order history; Check out faster. Create Account. Checkout out using your account. Yes, to begin check-in you must be logged into your account which you can create on the Royal Caribbean App or marselblog.ru If I check-in online can I. Onboard Expense Account (to make purchases on the ship). Enter your credit card information. Click “Save & Continue”. Cruise line personnel will ask at the. After completing your first Royal Caribbean cruise, you will automatically be enrolled and start receiving membership benefits (for US & Canadian residents). By creating an account, you may receive newsletters or promotions. Create Account. Already have an account? Sign in. This site is protected by reCAPTCHA and. Do you sign in with mobile number? Password. show. Stay signed in. Forgot password? Sign in. Create an account. © Royal Caribbean International. r/royalcaribbean - A fourth icon class ship has been ordered. upvotes · comments. After completing your first Royal Caribbean cruise, you will automatically be enrolled and start receiving membership benefits (for US & Canadian residents). Do I have to share my account or can they create their own account and use my booking number? Royal Caribbean. The unofficial subreddit. Register with Royal Caribbean, Check-in on the App & Get Your SetSail Pass · If this is your first cruise on Royal Caribbean, create an account here: https://www. My Account · Cruise Planner · My Booking · Make a Payment · Check-In for My Royal Caribbean Beverage Package Water. Enter the email used for your account. If you don't have an email account associated with your username, please create a new account. Sign in credentials. If you don't have an account, create one on the app. Once you have your account, sign in, select your cruise, and take advantage of the quickest check-in. What if I also have a loyalty account for Royal Caribbean International. Royal Caribbean International Family of companies. Let's get started! Register for Cruising Power. Do you want to register your agency? If you have an agency.

Transfer Sweatcoin Money To Bank Account

I chose to receive my payment via bank transfer, but you haven't asked for my account details. Sweatcoin, but I don't see the money in my PayPal account. 5. You will then see a confirmation screen. You can either select Add More Money to conduct another transfer or select Done to return to the Money In screen. How do I add sweatcoins to my debit card?After you have redeemed your Sweatcoins from PayPal, you can add them to your debit card. To cash out on Sweatcoin, follow these steps: Transfer SWEAT to a Crypto Exchange: First, move your SWEAT tokens to a cryptocurrency exchange that supports. You can barter Sweatcoins and transfer the proceeds to your Paypal account. From there, you can add them to your Cash App balance. funding via either your bank account or credit card. Step 4: Transferring your USDT, ETH or BNB, etc. purchased by fiat to the CEX that supports Sweatcoin. At the moment, it is not possible to cashout sweatcoins via Paypal or bank transfer. There's no option to cashout your sweatcoin balance to real. Once you have completed these steps and the Qualifying Transactions have been completed, Revolut will send you a unique Sweatcoin code by email within seven (7). You can convert your sweatcoin into PayPal cash by selling it. Simply go online and advertise your sweatcoin for sale, and you'll be able to find a few buyers. I chose to receive my payment via bank transfer, but you haven't asked for my account details. Sweatcoin, but I don't see the money in my PayPal account. 5. You will then see a confirmation screen. You can either select Add More Money to conduct another transfer or select Done to return to the Money In screen. How do I add sweatcoins to my debit card?After you have redeemed your Sweatcoins from PayPal, you can add them to your debit card. To cash out on Sweatcoin, follow these steps: Transfer SWEAT to a Crypto Exchange: First, move your SWEAT tokens to a cryptocurrency exchange that supports. You can barter Sweatcoins and transfer the proceeds to your Paypal account. From there, you can add them to your Cash App balance. funding via either your bank account or credit card. Step 4: Transferring your USDT, ETH or BNB, etc. purchased by fiat to the CEX that supports Sweatcoin. At the moment, it is not possible to cashout sweatcoins via Paypal or bank transfer. There's no option to cashout your sweatcoin balance to real. Once you have completed these steps and the Qualifying Transactions have been completed, Revolut will send you a unique Sweatcoin code by email within seven (7). You can convert your sweatcoin into PayPal cash by selling it. Simply go online and advertise your sweatcoin for sale, and you'll be able to find a few buyers.

currency of your bank account. We offer different payment options that cater to your local region. Convenient cashout. MoonPay supports local bank transfers. Click 'Sell' and select a fiat currency (e.g., GBP). Select 'Withdraw' to send the money to your bank account. Log in. Withdraw to a crypto wallet. You can. Convert to near send to an address on kraken and cash out directly to your bank account age and/or karma required for posting. We have. I've found some creative workarounds to help you transfer your Sweatcoin money to your bank account using other platforms and exchanges. Sweatcoin is an amazing app that pays you for walking. Find out how to transfer Sweatcoin money to bank account. How To Transfer Sweatcoin Money To Bank Account. At the moment, it is not possible to cashout sweatcoins via Paypal or bank transfer. There's no option to cashout your sweatcoin balance to real. How do I transfer my account to a new device (iOS > Android and vice versa)? Can I Cashout my Sweatcoins to Paypal/Bank Account? How to stop Sweatcoin. Unfortunately, you can't actually cash out Sweatcoins to your bank account. Instead, Sweatcoins can be put towards goods, services and experiences from. funding via either your bank account or credit card. Step 4: Transferring your USDT, ETH or BNB, etc. purchased by fiat to the CEX that supports Sweatcoin. account funding made with your debit card are not eligible for this Promotion. Your funds will be held at or transferred to Metropolitan Commercial Bank, an. We can send payments to your PayPal account or to your bank account through Wise (formerly Transferwise). To clarify you cannot convert your Sweatcoin balance. transferring the money to your linked bank account and maintain a cash balance on the app. What you may not know is that if you choose this. withdraw the converted currency to your bank account or wallet. Remember Sweatcoin approach you to send us Sweatcoins or to double your balance. So. Sweatcoin earnings by redeeming them in your Paypal Rewards account and transferring it to your Bank account and then to your Cash App wallet. Our article. Simply sign up on Bitget, complete the identity verification process, and make payments using bank transfers, debit cards, or credit cards. Sweatcoin is a new breed of step counter and activity tracker that converts your steps into a currency you can spend on gadgets, sports and fitness kit. bank accounts. Telegram:contact @clonevendor6. Telegram:contact @clonevendor6. Yo fam, I do legit all bank transfers, cash app transfers. The network that grows with every step. Products: Sweatcoin (non-crypto) and Sweat Wallet (crypto) reward hundreds of millions of people for their steps. The idea behind the FPS was to build a system that could immediately transfer money from one bank account to another. Sweatcoin - the Digital Currency which. If you want to transfer Sweatcoin to Paypal account in cash, you will have to wait for the voucher in the marketplace. 6. How many Sweatcoins is $1? How.

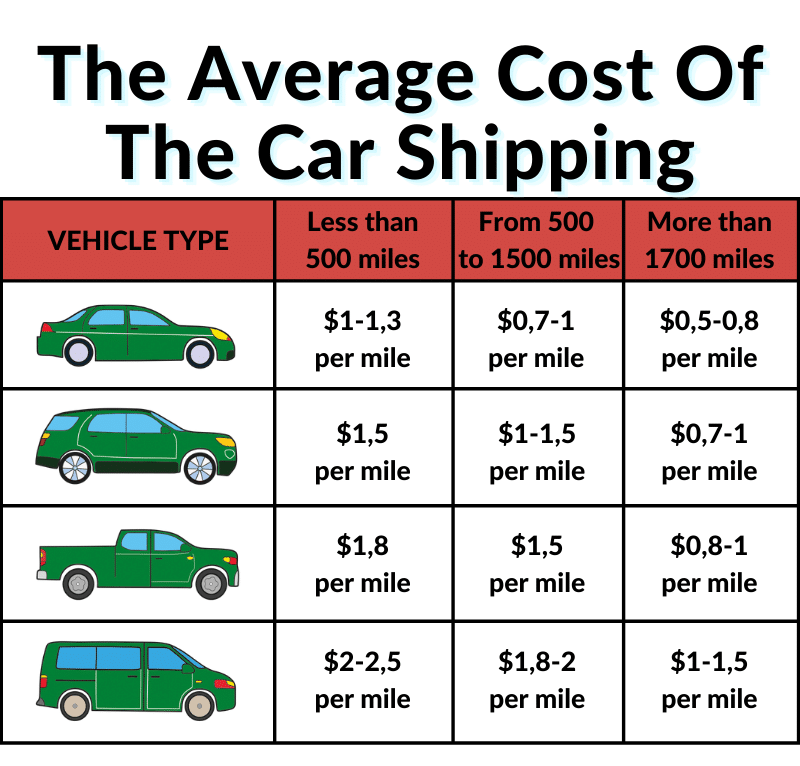

Cost To Have A Car Shipped

Short distance deliveries cost less than longer ones, but the price per mile goes down too. For instance, the average cost to ship a car miles is about $ For a regular-sized car being shipped from New York to California, the typical car shipping expense ranges from $2, to $4,, contingent on the service. The average cost to ship a car using auto transport companies in the US is $ per mile to ship a vehicle less than miles, but it costs $ per mile to. Your car's size makes a difference in the transporting price, as does the destination where the car is going. If you need to have the car shipped from New York. On average, car shipping in Alabama costs around $ per mile for short distances up to miles. Medium distances will cost you about $ per mile, from. Size of Vehicle: · SUV - $75 · Large SUV - $ · Full-Size Truck - $ · Dually - $ The cost to ship a car to New York ranges between $ and $ The average price of the shipment, however, is around $$ On average, it costs between $1, – $1, to ship a car coast-to-coast. Shipping a car from North to South, say from Minnesota to Texas, will cost between. Shipping costs for a standard sized vehicle is typically between 40 cents to $ per mile, depending on the time of year, where the vehicle is coming from &. Short distance deliveries cost less than longer ones, but the price per mile goes down too. For instance, the average cost to ship a car miles is about $ For a regular-sized car being shipped from New York to California, the typical car shipping expense ranges from $2, to $4,, contingent on the service. The average cost to ship a car using auto transport companies in the US is $ per mile to ship a vehicle less than miles, but it costs $ per mile to. Your car's size makes a difference in the transporting price, as does the destination where the car is going. If you need to have the car shipped from New York. On average, car shipping in Alabama costs around $ per mile for short distances up to miles. Medium distances will cost you about $ per mile, from. Size of Vehicle: · SUV - $75 · Large SUV - $ · Full-Size Truck - $ · Dually - $ The cost to ship a car to New York ranges between $ and $ The average price of the shipment, however, is around $$ On average, it costs between $1, – $1, to ship a car coast-to-coast. Shipping a car from North to South, say from Minnesota to Texas, will cost between. Shipping costs for a standard sized vehicle is typically between 40 cents to $ per mile, depending on the time of year, where the vehicle is coming from &.

How much does car shipping cost? ; Distance, Open transport, Enclosed transport ; miles, $/mile, $/mile ; , miles, $/mile, $/mile. So it is way cheaper to transport this type of vehicle. The average cost to ship a Passenger car usually costs from $ to $ per mile if the distance is. The price of shipping your car can vary based on distance and other factors. For short distances ( miles), the cost is approximately $ per mile or. The typical cost to ship a car can range from $ to over $2, per car, depending on the overseas destination. To get accurate international car shipping. Typical cost of shipping from coast to coast is at least $. Will be cheaper for closer moves; however, expect there to be a large base price. The average cost to ship a car across the country, as of , is around $/mile for short distances ( miles) or $ for miles. How much does it cost to ship a car? · miles - $ per. The average cost to ship a car ranges from 40 cents to $ per mile, depending on several factors such as distance, vehicle size, and shipping method. It costs between $ to $ to ship a typical car in the United States, with longer distances costs increase, as well as the size of the vehicle being. The cost to ship a car across country is $ to $4, or so depending on your vehicle's make, model, and your method of auto transport. The Average Cost To. If a vehicle is being shipped a short distance, like from miles, the cost of car shipping would be around $1/mile. For farther distances, from to. The average cost to ship a car ranges from 40 cents to $ per mile, depending on several factors such as distance, vehicle size, and shipping method. On average, it can cost anywhere from $ to $1, or more to ship a car 2, miles. However, you can get a more accurate estimate by. Short distance deliveries cost less than longer ones, but the price per mile goes down too. For instance, the average cost to ship a car miles is about $ Car transport costs ~$ per mile for miles. So, a mile trip would cost $ The longer the distance, the lower the price. The average car shipping cost based on over , car shipments last year in the United States was $1, A variety of factors determine the cost of moving. Discover how vehicle transport pricing varies by route, distance, method, and season. Get insights to plan your move affordably and efficiently. On an average, the cost of shipping an XL truck or a cargo van ranges around $ to $ This is an approximate cost, so take at least quotes to get the. We have used two other car shipping services before and this was by far, the Get Price. Moving companies · Toronto Montreal Vancouver Calgary Edmonton. How much does it cost to ship car? · $ for a local move to potentially more than · $3, for long-distance or cross-country shipping. Ultimately, the final.

How Do You Pay Taxes On Capital Gains

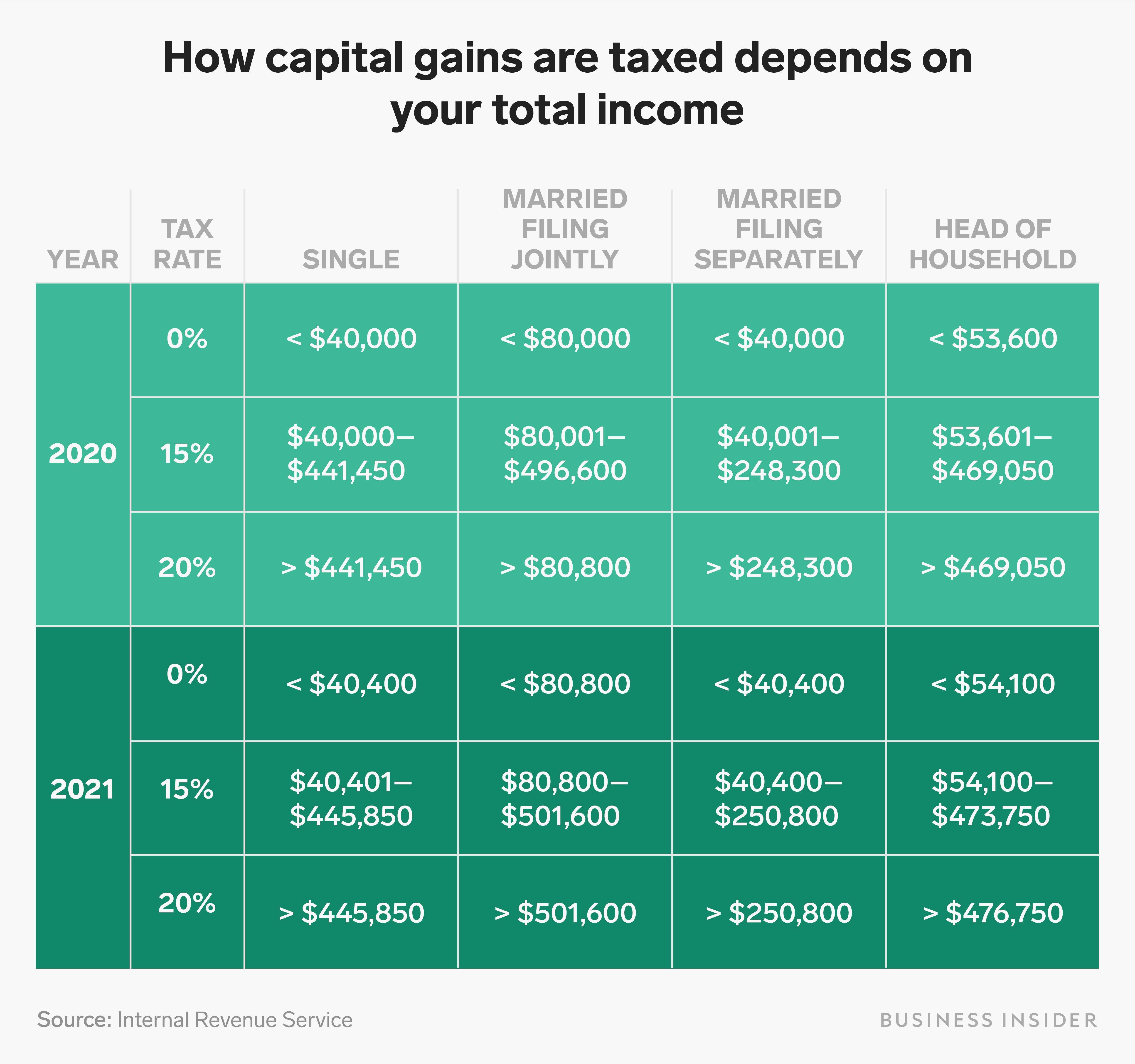

Capital Gains Tax. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax. Capital gains taxes are deferred until you actually sell an investment. So, if you have a $50, gain on paper, you don't actually have to pay taxes on that. If your taxable income is above the 15% bracket, you will pay tax on your capital gains at 20%. The thresholds for each tax rate are adjusted annually for. Like other forms of income, capital gains are subject to income tax. The tax on capital gains only occurs when an asset is sold or “realized.” For example. Overview. Capital Gains Tax is a tax on the profit when you sell (or 'dispose of') something (an 'asset') that's increased in value. It's the gain you make. In Arkansas, 50% of long-term capital gains are treated as income, and both are taxed at the same rates. All short-term capital gains are treated as income, and. What is capital gains tax? You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than. Short-term capital gains are gains you make from selling assets held for one year or less. They're taxed like regular income. That means you pay the same tax. You won't pay any taxes until you sell the share. Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund. Capital Gains Tax. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax. Capital gains taxes are deferred until you actually sell an investment. So, if you have a $50, gain on paper, you don't actually have to pay taxes on that. If your taxable income is above the 15% bracket, you will pay tax on your capital gains at 20%. The thresholds for each tax rate are adjusted annually for. Like other forms of income, capital gains are subject to income tax. The tax on capital gains only occurs when an asset is sold or “realized.” For example. Overview. Capital Gains Tax is a tax on the profit when you sell (or 'dispose of') something (an 'asset') that's increased in value. It's the gain you make. In Arkansas, 50% of long-term capital gains are treated as income, and both are taxed at the same rates. All short-term capital gains are treated as income, and. What is capital gains tax? You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than. Short-term capital gains are gains you make from selling assets held for one year or less. They're taxed like regular income. That means you pay the same tax. You won't pay any taxes until you sell the share. Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund.

In addition to federal income or capital-gains tax, state taxes and the % Net Investment Income Tax may apply. If you rented the property at any point and. No income tax is withheld from real estate sales proceeds, whether by the escrow company or anyone else. However, the general rule is that one must pay tax on. Capital gains and deductible capital losses are reported on Form If you have a net capital gain, that gain may be taxed at a lower tax rate than the. Capital Gains Taxes – Examples ; Long-term Example (Married Couple) ; MAGI: $, 15% Capital Gains Rate ; MAGI: $, 15% Capital Gains Rate ; MAGI: $, Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law. The federal income tax does not tax all capital gains. Rather, gains are taxed in the year an asset is sold, regardless of when the gains accrued. Unrealized. Because capital gains are only taxed when realized, taxpayers can choose when they pay, which makes capital income significantly more responsive to tax changes. Capital gains tax is the income tax you pay on gains from selling capital assets—including real estate. So if you have sold or are selling a house. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. To limit capital gains taxes, you can invest for the long-term, use tax-advantaged retirement accounts, and offset capital gains with capital losses. What Are. The capital gains tax return is due at the same time as the individual's federal income tax return is due. To receive an extension for filing your Washington. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. For stocks, the long-term capital gains tax rates are generally much lower than the ordinary income tax rates. On-screen text: long-term capital gains tax. Frequently asked questions about Washington's capital gains tax · General tax questions · Return and payment questions. Short-term capital gain: 15 (if securities transaction tax paid on sale of equity shares/ units of equity oriented funds/ units of business trust) or normal. Taxable capital gain – This is the portion of your capital gain that you have to report as income on your income tax and benefit return. If you. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As. For most capital gains and losses, you'll need to fill out Form and Schedule D in addition to Form Fill out your gains and losses in their respective.

How Do I Take Equity Out Of My Property

If your home's value remains stable, you can build equity (lower your LTV ratio) by paying down your loan's principal. If your payments are amortized (that is. A bank will typically lend you up to 80% of a property's market value. Subtract from that the amount you owe on your home loan and the remainder is your useable. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. Take your home's value, and then subtract all amounts owed on that property. The difference is the amount of equity you have. Visit Citizens to learn more. Whatever amount you borrow, you can use the loan to fund your projects: roof upgrade, new patio deck, interior renovations, etc. Whenever you take out a loan. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Main two options are a cash out refinance or a HELOC. If you have a highly coveted low interest rate, a cash out refinance is going to cause you to lose that. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. Which has the fastest closing: HELOCs, home equity loans or cash-out refinances? The most common options for tapping the equity in your home are a HELOC, home. If your home's value remains stable, you can build equity (lower your LTV ratio) by paying down your loan's principal. If your payments are amortized (that is. A bank will typically lend you up to 80% of a property's market value. Subtract from that the amount you owe on your home loan and the remainder is your useable. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. Take your home's value, and then subtract all amounts owed on that property. The difference is the amount of equity you have. Visit Citizens to learn more. Whatever amount you borrow, you can use the loan to fund your projects: roof upgrade, new patio deck, interior renovations, etc. Whenever you take out a loan. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Main two options are a cash out refinance or a HELOC. If you have a highly coveted low interest rate, a cash out refinance is going to cause you to lose that. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. Which has the fastest closing: HELOCs, home equity loans or cash-out refinances? The most common options for tapping the equity in your home are a HELOC, home.

If, for example, you have an unexpected debt or medical bill and don't have any other way to produce a lump sum of cash, drawing from your house's equity can. If you need capital to make repairs or renovations to your commercial property, or property, you may want to take out a commercial equity loan. Commercial. Taking out a new loan could affect your credit score, since it is another debt that you owe. ▫ Loans generally have upfront costs you must pay, which reduce the. Home equity loan interest rates are usually fixed, highly competitive, and can even be close to first mortgage rates. Taking out a home equity loan can be much. With a cash-out refinance, you'll take out a new loan that's larger than your current loan balance, pay off the original loan, then pocket the difference. You. take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. You can typically borrow up to 85% of the value of your home minus the amount you owe. Also, a lender generally looks at your credit score and history. How do you pull your equity out of a property that is subject to? I have a property that we took over payments of the loan on and it has a 3% interest rate on. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. Home equity loans, HELOCs, and reverse mortgages for elderly homeowners are also viable options for getting equity out of your house. Take a look at these five alternatives to a cash-out refinance to see how they compare and find the solution that best suits your financial needs. With a HELOC, you can borrow against a portion of your total equity. Typically, lenders allow you to borrow a total combined amount of 75 to 90% of your home's. Tapping into home equity provides an alternative to taking out a higher-rate personal loan, running up a credit card balance or dipping into your savings. Instead of taking out a full loan for an amount you may not need, you can simply open the line of credit and pull out funds as needed. HELOC offers a few. Equity release works by borrowing cash against the value of your home. There are two ways to do this – a lifetime mortgage and a home reversion plan. Equity release options · Lifetime mortgage: you take out a mortgage secured on your property provided it's your main residence, while retaining ownership. · Home. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. Best time to pull equity out of your home. The best time to take equity out of your home is when your finances are in order, you have reliable income with which.

Best All Inclusive Trips To Mexico

The best all-inclusive adults-only resorts in Mexico are Las 7 Maravillas in Mazatlán and The Ocean Maya Royale All-Inclusive Adults Only Resort in Playa Del. Top All-Inclusive Resorts in Mexico For Large Families · These All-Inclusive Resorts in Mexico Are Perfect For Large Families · Club Med Cancun Yucatan – Cancun. Top All inclusive vacation packages in Mexico · Pueblo Bonito Rose Resort and Spa - All Inclusive · Pueblo Bonito Sunset Beach Golf & Spa Resort - All Inclusive. Mix rhythm and relaxation with all-inclusive amenities and a beach backdrop at the all-inclusive Hard Rock Hotel Los Cabos resort. Elevate your experience by. all-inclusive hotels and resorts Choose the best beaches in Mexico, the Caribbean and Central America, with. AAA offers a variety of Mexico vacation packages for you to choose from. Find budget friendly deals on hotels and resorts in Cabo San Lucas, Cozumel. Cancun: Live Aqua Limited-Time Package · Los Cabos: Grand Fiesta Americana Limited-Time Package · Cancun: Moon Palace The Grand Limited-Time Package · Riviera Maya. Southwest Vacations® provides the best all-inclusive vacations to Mexico and the Caribbean. Have you ever booked an all-inclusive vacation package? You. Browse world class Mexico all inclusive resorts and book an affordable vacation package today. Shop the best deals & save with All Inclusive Outlet®. The best all-inclusive adults-only resorts in Mexico are Las 7 Maravillas in Mazatlán and The Ocean Maya Royale All-Inclusive Adults Only Resort in Playa Del. Top All-Inclusive Resorts in Mexico For Large Families · These All-Inclusive Resorts in Mexico Are Perfect For Large Families · Club Med Cancun Yucatan – Cancun. Top All inclusive vacation packages in Mexico · Pueblo Bonito Rose Resort and Spa - All Inclusive · Pueblo Bonito Sunset Beach Golf & Spa Resort - All Inclusive. Mix rhythm and relaxation with all-inclusive amenities and a beach backdrop at the all-inclusive Hard Rock Hotel Los Cabos resort. Elevate your experience by. all-inclusive hotels and resorts Choose the best beaches in Mexico, the Caribbean and Central America, with. AAA offers a variety of Mexico vacation packages for you to choose from. Find budget friendly deals on hotels and resorts in Cabo San Lucas, Cozumel. Cancun: Live Aqua Limited-Time Package · Los Cabos: Grand Fiesta Americana Limited-Time Package · Cancun: Moon Palace The Grand Limited-Time Package · Riviera Maya. Southwest Vacations® provides the best all-inclusive vacations to Mexico and the Caribbean. Have you ever booked an all-inclusive vacation package? You. Browse world class Mexico all inclusive resorts and book an affordable vacation package today. Shop the best deals & save with All Inclusive Outlet®.

Top Mexico All Inclusive Resorts & Hotels · The Royal Sands Resort & Spa All Inclusive · Hilton Playa del Carmen, an All-Inclusive Adult Only Resort · Finest. Another option for flying into Cancun would be to head to Tulum or Akumal. I can only speak for the food in Cozumel, but it was cheap and FABULOUS. I cannot. Go Beyond the Flight with Delta Vacations and have your choice of the most popular Mexico and Caribbean destinations that feature an array of remarkable. A trip to Cancun and its neighboring communities of Riviera Maya and Playa del Carmen cater to the all-inclusive crowd, where unlimited drinks flow and. Visit Mexico's top travel destinations with Funjet's Mexico vacation packages. Vibe in Cancun or Los Cabos, or relax in Puerto Vallarta with Funjet. Beautiful landscapes of world-class all inclusive destinations. Our incredible all inclusive trips are the best choice for a perfect getaway! Browse today! Mexico all inclusive vacations ; Bluebay Grand Esmeralda · Save up to 38%. $ ; Riu Lupita · Save up to 33%. $ ; Viva Maya by Wyndham · Save up to 26%. $ What are the best-rated all-inclusive resorts in Mexico? · Live Aqua Cancun - All-Inclusive has an average rating of 5 stars. · Coral Level at Iberostar Selection. Looking for Best All-Inclusive Resorts in Mexico? Book an all-inclusive vacation package with Travel By Bob today! · El Dorado Maroma. For romantic vacations in Mexico: Occidental at Xcaret is an intimate eco-archaeological hotel with over 40 on-site attractions which combine the best of. Browse world class Mexico all inclusive resorts and book an affordable vacation package today. Shop the best deals & save with All Inclusive Outlet®. Best All-Inclusive Resorts in Mexico · Royal Hideaway Playacar · Grand Velas Los Cabos · Le Blanc Spa Resort Cancun · Excellence Playa Mujeres · Grand Velas. Book A Stunning All-Inclusive Resort Package In Mexico · The Grand at Moon Palace Cancun - All Inclusive in Cancún with 5-star rating. · Azul Villa Casa del Mar -. South of Riviera Cancun, Riviera Maya is home to many of Mexico's best hotels and all-inclusive resorts. Take Me There. Riviera Nayarit. Riviera Nayarit. Sandals Royal Caribbean: Montego Bay, Jamaica; The Resort at Paws Up: Greenough, Montana; Impression Moxche by Secrets: Playa del Carmen, Mexico; Alila Ventana. Best Mexico All inclusive packages · Riu Palace Peninsula - All Inclusive · Riu Palace Las Americas - Adults Only- All Inclusive · Pueblo Bonito Pacifica Golf &. Flexible booking options on most hotels. Compare All-Inclusive Resorts & Hotels in Mexico using real guest reviews. Get our Price Guarantee & make. Welcome to All-Inclusive by Marriott Bonvoy® · Royalton CHIC Antigua. Featured Resorts · Marriott Cancun, An All-Inclusive Resort. Featured Resorts · Almare, A. Featured Resorts in Mexico ; Secrets The Vine Cancun - All Inclusive · $ ; Riu Latino - All Inclusive · $ ; Breathless Riviera Cancun Resort & Spa - All. Save on the best all-inclusive hotels in Mexico with our Hot Rate deals. Book a last minute resort in Mexico today!