marselblog.ru Community

Community

Pre Approved Mortgage Estimate

Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. A mortgage pre-qualification can determine an estimated amount you might be able to borrow when you complete a full mortgage application. However, at this stage. How much home can you afford? Use our calculator to find out. Then see how much you're preapproved for. Pre-qualification is an early estimate of what you may be able to borrow based on self-reported financial information and a soft credit check. It's a way for. Mortgage pre-approval, also sometimes referred to as mortgage pre-qualification, signals to realtors, builders and sellers that you're a serious buyer. It also. How to get pre-approved for a mortgage · Check your credit score. · Calculate your DTI. · Gather the necessary documentation. · Shop different mortgage lenders. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. A general guideline for securing a mortgage is that they're typically affordable within two and two and a half times your yearly income. That means if you make. Our calculator estimates what you can afford and what you could get prequalified Not sure of the difference between mortgage prequalification and preapproval? Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. A mortgage pre-qualification can determine an estimated amount you might be able to borrow when you complete a full mortgage application. However, at this stage. How much home can you afford? Use our calculator to find out. Then see how much you're preapproved for. Pre-qualification is an early estimate of what you may be able to borrow based on self-reported financial information and a soft credit check. It's a way for. Mortgage pre-approval, also sometimes referred to as mortgage pre-qualification, signals to realtors, builders and sellers that you're a serious buyer. It also. How to get pre-approved for a mortgage · Check your credit score. · Calculate your DTI. · Gather the necessary documentation. · Shop different mortgage lenders. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. A general guideline for securing a mortgage is that they're typically affordable within two and two and a half times your yearly income. That means if you make. Our calculator estimates what you can afford and what you could get prequalified Not sure of the difference between mortgage prequalification and preapproval?

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. I'm not talking about a mortgage calculator but a pre-approval calculator where you can input things like income, debt, interest rate. During pre-qualification, the lender will provide an estimate of a loan amount for you. However, the same does not apply for pre-approval; you won't find out. Once you have an idea how much you believe you can afford, get pre-qualified. A pre-qualification is an informal agreement between you and a broker or lender. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Our pre-qualification calculator will help you get & idea of how much you could qualify for. The prequalification calculator will give you the maximum. Pre-approvals are valid for 90 days. Perks% rate discount1; FREE Pre-Approval good for 90 days; $ credit towards closing costs. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-. The pre-qualification you receive from a lender may differ from this estimate based on the lender's requirements for loan approval. Your lender will also be. The pre-qualification you receive from a lender may differ from this estimate based on the lender's requirements for loan approval. Your lender will also be. Use Bankrate's loan prequalification calculator to determine your ability to qualify for a home or auto loan. Mortgage Refinance Rates. Popular Calculators. Rate We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search. A mortgage prequalification is a quick and simple way to find out how much you could borrow, and what your estimated rate and payment would be. Benefits of a. Why get pre-approved for a mortgage with us? · Lock in your rates for days · Know your budget · Shop with confidence. Both are initial steps in the mortgage process, with pre-qualified being an indicator of the size of the mortgage you'll likely be approved for, while pre-. Buyers benefit by consulting with a lender, obtaining a pre-approval letter, and discussing loan options and budgeting. The lender will provide the maximum loan. Buy Down. A cash payment made by either seller or buyer to reduce a borrower's interest rate. Closing Costs. The expenses associated with a mortgage loan that. Getting pre-approved for a home loan is a best practice to help you determine how much you can borrow before placing an offer on a new home. Use our calculator to get an estimate on your price range that fits your budget, along with mortgage details. Find out what you'd owe each month given a specific purchase price, interest rate, length of your loan, and the size of your down payment. Try it.

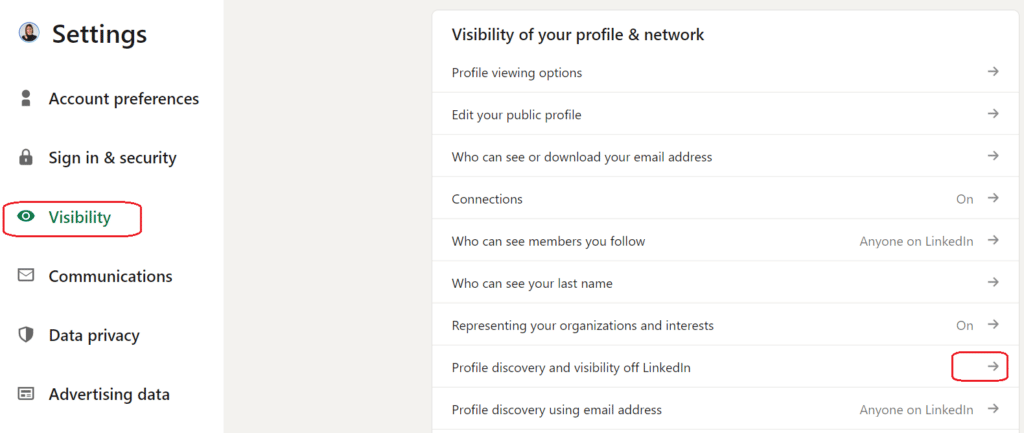

Linkedin Company Page Not Showing Up In Search

From the My pages pane on the left side of your LinkedIn homepage, click the correct Page name. New Pages might not appear in LinkedIn search but will appear on. Whether your audience is directly on LinkedIn, or searching topics related to your company or industry on a search engine, a well-optimised company page will. Contact LinkedIn, If your company has created a profile but it does not appear in the search results. Make sure first that you have typed the. Whether your audience is directly on LinkedIn, or searching topics related to your company or industry on a search engine, a well-optimised company page will. Make sure that your company page is public. Private profiles and brand pages are currently not supported. To connect to LinkedIn Company Pages, you need a. A common reason why your Google My Business listing may not be showing up in search results is that you haven't gone through the verification process yet. From the top of your LinkedIn homepage, type the company, university, or high school name into the Search bar. · Click Companies or Schools at the top of the. All you'd have to do is put the LinkedIn URL into that search window that apprears where the LInkedIn contact is displayed from a contact in HubSpot (bottom. First, ensure that you are an admin of the company page on the right LinkedIn account. Some users have two accounts on LinkedIn and can confused about which one. From the My pages pane on the left side of your LinkedIn homepage, click the correct Page name. New Pages might not appear in LinkedIn search but will appear on. Whether your audience is directly on LinkedIn, or searching topics related to your company or industry on a search engine, a well-optimised company page will. Contact LinkedIn, If your company has created a profile but it does not appear in the search results. Make sure first that you have typed the. Whether your audience is directly on LinkedIn, or searching topics related to your company or industry on a search engine, a well-optimised company page will. Make sure that your company page is public. Private profiles and brand pages are currently not supported. To connect to LinkedIn Company Pages, you need a. A common reason why your Google My Business listing may not be showing up in search results is that you haven't gone through the verification process yet. From the top of your LinkedIn homepage, type the company, university, or high school name into the Search bar. · Click Companies or Schools at the top of the. All you'd have to do is put the LinkedIn URL into that search window that apprears where the LInkedIn contact is displayed from a contact in HubSpot (bottom. First, ensure that you are an admin of the company page on the right LinkedIn account. Some users have two accounts on LinkedIn and can confused about which one.

If your company has a company page set up by someone who is no longer with the company, and you're trying to gain access to the page, you'll. In order for your LinkedIn company page to become more visible in the Google search engine, you need to optimize the content. Update your. The most crippling aspect of LinkedIn company pages is the fact that you are not able to proactively connect with targeted prospects, have one-to-one. Since these profiles don't register as current employees, you won't be able to find them on company pages. But although the process is a bit different, it's. Check to see if the existing Page represents your organization. If your organization already has a Page, you can request admin access to it instead of creating. If you recently created your LinkedIn account, you'll need to wait before creating a Page. Wait at least one day before trying again. What if our desired URL is. Now you know why you may want to give someone access to your LinkedIn Company Page, it's time to show you the easiest way to to it! When she's not caught up. LinkedIn doesn't control that refresh process. If you're incorrectly appearing in search results on those sites, you can contact them directly to resolve. Creating a company profile will take you no more than 10 minutes. It's very simple. To fill out a business profile, you need to have up-to-date visuals and. Go to your LinkedIn Service Page admin view. · Select the correct LinkedIn Page. · On the Providing services module, click Show details. · On the Set up your. To access your Page admin view, from the My pages pane on the left side of your LinkedIn homepage, click the correct Page name. We can't guarantee that a Page will be displayed in the results list that appears as you type its name into a search box. The Page names that appear are based. What's your question? Clear search. Submit search. Dropdown menu, expand to This section may not appear depending on your admins' feature setting. If the company logo is missing on LinkedIn, it means that there is no connection to a LinkedIn page for the company. This matters to your LinkedIn profile. Your post was created over a year ago or your Page has exceeded posts. If you pin a post, it will show up even after a year has passed. · Another admin on. If you are with the same problem, just select "Create a new company" and type the name. Company pages will pop up. Share. Most likely, the company page name is NOT what you think it is. · Here is an example of a company who uses a PLUS SIGN in their logo and branding. The most crippling aspect of LinkedIn company pages is the fact that you are not able to proactively connect with targeted prospects, have one-to-one. All you'd have to do is put the LinkedIn URL into that search window that apprears where the LInkedIn contact is displayed from a contact in HubSpot (bottom. This means you simply turn on or off the profile sections that make your company page URL visible on public search engines. Finding a LinkedIn company page.

Paychek Plus Atm Near Me

Paychek Plus! offers an alternative to the traditional banking services ATM transaction, press “yes” to accept the surcharge and proceed with your. DCU has nine branches and multiple ATMs across Tampa Bay and Central Florida. As a DCU member, you also have nationwide access to your account. According to Features of PaychekPLUS! Elite: You can withdraw money from Allpoint, Comerica, and MoneyPass ATMs without a fee. Find Allpoint ATMs using our intuitive locator and mobile applications. Can't even access my savings either because you can't go to an atm and draw money from their savings part you gotta do only checking. And I can'. Paychek Plus! offers an alternative to the traditional banking services If the surcharge screen appears during your Allpoint. ATM transaction, press “yes” to. Allpoint ATM Networks are “In-Network” for you, and all other ATMs are “Out-of-. Network”. Teller Assisted Cash. Withdrawal Decline. $ This fee is charged. Free cash withdrawals from any bank's ATM nationwide. Self-Service Channels: Faysal digibank Internet Banking; Inter-Bank Funds Transfer (1 link member banks). If you need assistance with your Darden Payroll Card, you MUST visit the PaychekPLUS! Debit or ATM, Debit or ATM (after hours), Paychek Plus! offers an alternative to the traditional banking services ATM transaction, press “yes” to accept the surcharge and proceed with your. DCU has nine branches and multiple ATMs across Tampa Bay and Central Florida. As a DCU member, you also have nationwide access to your account. According to Features of PaychekPLUS! Elite: You can withdraw money from Allpoint, Comerica, and MoneyPass ATMs without a fee. Find Allpoint ATMs using our intuitive locator and mobile applications. Can't even access my savings either because you can't go to an atm and draw money from their savings part you gotta do only checking. And I can'. Paychek Plus! offers an alternative to the traditional banking services If the surcharge screen appears during your Allpoint. ATM transaction, press “yes” to. Allpoint ATM Networks are “In-Network” for you, and all other ATMs are “Out-of-. Network”. Teller Assisted Cash. Withdrawal Decline. $ This fee is charged. Free cash withdrawals from any bank's ATM nationwide. Self-Service Channels: Faysal digibank Internet Banking; Inter-Bank Funds Transfer (1 link member banks). If you need assistance with your Darden Payroll Card, you MUST visit the PaychekPLUS! Debit or ATM, Debit or ATM (after hours),

Support Local Businesses · ATM Services. Smarter Technology. Click to Pay · Tap to Pay · Mobile Payments · Visa Installments. Protection + Security. Security +. Plus Prepaid Card,,,,Yes, ,Active,,GPR (General Purpose Reloadable),Yes,Netspend,H-E-B,Axos Bank/HEB Visa Plus Prepaid. Allpoint ATM Networks are “In-Network” for you, and all other ATMs are “Out-of-. Network”. Teller Assisted Cash. Withdrawal Decline. $ This fee is charged. ATM. Visit the website on the back of your card to locate the closest Allpoint ATM to you. You also have free access to your pay each pay period. Consult. DCU has nine branches and multiple ATMs across Tampa Bay and Central Florida. As a DCU member, you also have nationwide access to your account. “Card” means the PaychekPLUS! Elite® Visa Payroll Card issued to you by The Bancorp Bank, Wilmington, Delaware. “Issuer” means The. Bancorp Bank or its. You can withdraw money free of charge using Allpoint, Comerica and MoneyPass ATM networks. Here you can find the closed ATM to your location. All ATM transactions are treated as Cash withdrawal transactions. You should dollar amount”), plus (b) one percent (1%) times the base dollar amount. Employees of Northwestern University using the Paychek Plus pay card are eligible for one free ATM me in the orientation process. • I understand that. Mobile & ATM Deposit · Mobile Banking FAQ · Zelle®. Security. Security. Prevention Tips plus an emergency fund, or you can use our emergency fund calculator. With your PIN, you may use your Card to obtain cash from any Automated Teller Machine (“ATM”) that displays the Visa®, Plus®, Allpoint®, or Accel/Exchange. “Card” means the PaychekPLUS! Elite® Visa Payroll Card issued to you by The Bancorp Bank, Wilmington, Delaware. “Issuer” means The. Bancorp Bank or its. That's because you can make PIN purchases where accepted and even request cash back at participating merchants. To open a Comerica ATM Card, visit your local. You will need to use your new ATM/PIN to operate an ATM or Pin Debit transactions. Verify the amount of your purchase, plus any cash back. 5. Select. It allows me to make phone calls, answer emails, talk with general contractors ATM withdrawals. Restrictions include: no international transactions. [deleted]. OP • 4y ago. I called and got an unblock then went to a nearby atm and it worked out when I withdrawed. Upvote 1. Downvote Award. ATM. Visit the website on the back of your card to locate the closest Allpoint ATM to you. You also have free access to your pay each pay period. What bank. Don't worry about ATM fees. Get cash back when making a purchase! Get your balance anytime with text message alerts! The all-new mobile app is here. Find an ATM – Use the GPS feature to locate the closest in-network ATM to you. Enjoy Safety and Security – Built using the highest standards of mobile web. myself but evidently you're not If there is a CVS/Walgreens/Circle K near you with an ATM they don't charge a fee for the pay cards.

Money Earning Games Without Investment

Quizzy is undoubtedly on the best Paytm cash earning games without investment. It is the most fun quiz game to play. You must be quick to answer all questions. money-earning games that offer the chance to win real money Ludo Earning App Without Investment · Ludo Leaderboard · Games Like Ludo. Popular. Mistplay is a platform that allows you to earn real money by playing various games. While some games may require in-. GAMEE PRIZES is an arcade filled with addictive, free-to-play (F2P) games designed to provide endless entertainment. 4. CardBaazi. If you are a sucker for card games, CardBaazi is your one stop destination for the most entertaining card games. You can play skill based. In this article, we will explore a variety of online games and platforms that allow you to earn money while having fun. This article briefly elucidates the best games to play to earn money and how people can take advantage of this opportunity. Top Free Games to Play and Earn Real Money on Swagbucks Now · Solitaire Cash: Deposit $5 and play at least 3 games, receive $ · Blackout Bingo: Install the app. Teen Patti is one of the most popular online real money games in India. It's more of one of the Indian real money earning games and is a simpler version of. Quizzy is undoubtedly on the best Paytm cash earning games without investment. It is the most fun quiz game to play. You must be quick to answer all questions. money-earning games that offer the chance to win real money Ludo Earning App Without Investment · Ludo Leaderboard · Games Like Ludo. Popular. Mistplay is a platform that allows you to earn real money by playing various games. While some games may require in-. GAMEE PRIZES is an arcade filled with addictive, free-to-play (F2P) games designed to provide endless entertainment. 4. CardBaazi. If you are a sucker for card games, CardBaazi is your one stop destination for the most entertaining card games. You can play skill based. In this article, we will explore a variety of online games and platforms that allow you to earn money while having fun. This article briefly elucidates the best games to play to earn money and how people can take advantage of this opportunity. Top Free Games to Play and Earn Real Money on Swagbucks Now · Solitaire Cash: Deposit $5 and play at least 3 games, receive $ · Blackout Bingo: Install the app. Teen Patti is one of the most popular online real money games in India. It's more of one of the Indian real money earning games and is a simpler version of.

What Are The Top Games To Earn Money Online Without Investment? · Mukesh Saini · Strategy Champs: Outsmart and Conquer · Card Sharks: Shuffle and. Many people think of Swagbucks as a shopping app that helps you earn cash back for purchases or for surfing the web. But you can also play games and earn. Best. OneAd app is one of the popular Paytm cash games that lets you earn through multiple sources by choosing interesting tasks of your choice. You can compete in. This page provides information about different ways to earn on Roblox and how to convert earned Robux to cash through the Developer Exchange program. 2. InboxDollars: InboxDollars is another app that offers various ways to earn money, including playing games. You can earn cash rewards by. Here, I have reviewed the 42 best Paytm Cash Earning Games in India. These are the top-rated application to play fantasy games and earn real money as the. Here, I have reviewed the 42 best Paytm Cash Earning Games in India. These are the top-rated application to play fantasy games and earn real money as the. Why Should You Play CASHFLOW Classic? Playing the CASHFLOW Classic free online game will help you Learn how to invest without losing your money. Why haven't. Rummy is one of the Paytm online earning games without investment that involves creating sets or sequences of cards from a standard deck of 52 cards. The. If you want to earn more income with money games real cash earning apps or game in pakistan without investment then this free earning money in pakistan game is. What is a suggested gaming app to earn money without an investment? It's not just a game but an opportunity to win money through color. 1- Klondike Solitaire: This is one of the most well-known cash rewards offering solitaire earning games. It involves dealing cards into several tableau piles. Top Apps like Lucky Spin for Android · Spin to Win - Real Cash App · Lucky Money - Feel Great Make it Rain · Buckspin · Phone Pocket · Watch King: Earn money online. These apps allow users to earn money by completing small tasks, such as watching videos, taking surveys, or playing games. They are often ideal for students or. We will be discussing more than 21 apps that you can play to earn Paytm cash without investment. Therefore, let's get right into it, starting with. In this blog, we will discuss how you can earn money by playing games with payout to PayPal. We'll also provide you with a step-by-step guide to help you get. Top 10 Money-Earning Apps Without Investment · Here is a list of 10 such apps that can help you earn some extra cash: · 1. Swagbucks: This app allows you to earn. Try marselblog.ru if you're a gamer. They reward a token based on the performance of you playing popular games. A basic matching game. Secondly, you are going to get offers of free goodies before every level and an ad after each one. This personally doesn't bug me because. Quizzy: An engaging quiz game where players can earn Paytm cash without any initial investment. · Winzo Gold: This Indian app offers various online games for.

How To Open Up An Index Fund

Get information about what index funds are, index fund verticals, and funds you can invest in on Public. Join Public to buy stock in any amount with no. You can buy and sell index funds by opening an investment account. If you open an investment account with a bank, credit union or another financial institution. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. HOW TO · Buy an S&P Index Fund · GET STARTED · How to buy an S&P index fund · It's surprisingly easy to buy an S&P fund, and you can usually set up your. To invest in an index fund, you'll need to open a brokerage account, a traditional IRA or a Roth IRA (you can often choose to invest in index funds through your. Market Cap/Style. Distribution Yield. Index Funds. Fund of Funds. ESG Funds Exchange-traded funds and open-ended mutual funds are considered a single. For example, you might put 60% of your money in stock index funds and 40% in bond index funds. You can start investing in index funds with one of the best. You can also open a Factsheet widget from another widget. GIF opening an empty factsheet widget from the Widget Gallery. Key features of an index Factsheet. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is. Get information about what index funds are, index fund verticals, and funds you can invest in on Public. Join Public to buy stock in any amount with no. You can buy and sell index funds by opening an investment account. If you open an investment account with a bank, credit union or another financial institution. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. HOW TO · Buy an S&P Index Fund · GET STARTED · How to buy an S&P index fund · It's surprisingly easy to buy an S&P fund, and you can usually set up your. To invest in an index fund, you'll need to open a brokerage account, a traditional IRA or a Roth IRA (you can often choose to invest in index funds through your. Market Cap/Style. Distribution Yield. Index Funds. Fund of Funds. ESG Funds Exchange-traded funds and open-ended mutual funds are considered a single. For example, you might put 60% of your money in stock index funds and 40% in bond index funds. You can start investing in index funds with one of the best. You can also open a Factsheet widget from another widget. GIF opening an empty factsheet widget from the Widget Gallery. Key features of an index Factsheet. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is.

Investing in an index fund means you're subject to market performance, even when markets fall. What are other factors to consider when choosing an index mutual. After fees, consider whether the fund has minimum initial investment requirements, transaction fees or deferred sales charges. Also assess the fund's track. Choose your investment platform: Begin by selecting an online brokerage or investment platform. · Open and fund an account: Once you've chosen a platform, you'll. Fidelity, Vanguard, and Schwab are the usual recommendations. You do this the same way as you'd open a bank account: contact the institution. Instead of hand-selecting which stocks or bonds the fund will hold, the fund's manager buys all (or a representative sample) of the stocks or bonds in the index. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is. It's possible to start investing in index funds and non-index funds with a low minimum investment, which can help investors without significant savings get. Think of an index fund as an investment utilizing rules-based investing. As of , index funds made up % of equity mutual fund assets in the US. However, you can buy shares of many index funds for well under $ per share. If you invest with a robo-advisor, they'll even divvy up your cash and buy. American Funds vs. the index*. The first retail S&P Index-tracking fund was founded in The chart shows how much a hypothetical. Step #1: Pick a brokerage and open an account. To buy an index fund, you need a brokerage account. Once your account is funded, you can buy and sell index funds. Some index funds may also use derivatives (such as options or futures) to help achieve their investment objective. Some index funds invest in all of the. Learn more about index funds; Identify the index you want to track; Pick the fund you want to buy; Open an investment account; Buy shares in the index fund. The last step is to buy shares from your chosen index fund. To do so, you must open an account through a broker. Again, every broker may offer different. invest in assets such as global real estate, commodities, leveraged loans, start-up companies and unlisted securities. It is important to have a complete. The last step is to buy shares from your chosen index fund. To do so, you must open an account through a broker. Again, every broker may offer different. When you make an investment in a mutual fund, there may be an up-front charge to buy shares called a transaction fee. Typically these are small costs, but they. Index funds are also highly accessible to investors of all kinds – from retail investors to institutional. They could be bought and sold easily on mutual fund. Determine Your Investment Goals · Choose the Right Index Fund · Gather the Necessary Documents · Open an Account with Fidelity · Fund Your Account · Set Up Your. First, there are open-end index mutual funds. You give your money to the up with big losers. Choosing Markets. Well and good, but in which markets.

Why Is Turbotax Charging Me To File

When I got to the end to e-file, it's charging me refund processing fee + state fee? Included with this product is one download of a TurboTax. Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free. TurboTax may be charging you $39 to pay with your refund because this payment option is known as a refund processing service. You shouldn't need TurboTax to file your taxes. The IRS can and should make “The problems with Free File lead me to conclude that it is time for. Review your fees to find out why you're being charged. Then, follow the directions to remove any unwanted charge. A: They will file your federal return electronically for free but will charge if you have your state return filed electronically. M. Parks. ·. Why is TurboTax Charging Me? · 1. Convenience and Ease of Use. TurboTax simplifies the complex process of tax filing. · 2. State Tax Filing Fees. I have used TurboTax® for years and was having trouble this year getting my state return correct. After several unsuccessful calls they could transfer me to the. charged. Processor, Rate, Fee. PAYcom/SpecialOffers/TurboTax. (Link2Gov Corporation). — Service. %, Minimum convenience fee $ When I got to the end to e-file, it's charging me refund processing fee + state fee? Included with this product is one download of a TurboTax. Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free. TurboTax may be charging you $39 to pay with your refund because this payment option is known as a refund processing service. You shouldn't need TurboTax to file your taxes. The IRS can and should make “The problems with Free File lead me to conclude that it is time for. Review your fees to find out why you're being charged. Then, follow the directions to remove any unwanted charge. A: They will file your federal return electronically for free but will charge if you have your state return filed electronically. M. Parks. ·. Why is TurboTax Charging Me? · 1. Convenience and Ease of Use. TurboTax simplifies the complex process of tax filing. · 2. State Tax Filing Fees. I have used TurboTax® for years and was having trouble this year getting my state return correct. After several unsuccessful calls they could transfer me to the. charged. Processor, Rate, Fee. PAYcom/SpecialOffers/TurboTax. (Link2Gov Corporation). — Service. %, Minimum convenience fee $

Federal Return · Tax Return Construction - Business & Self-Employed For returns containing a Schedule C, E, or F or the Form · e-file. For a return. If your tax return and/or refund have been impacted, such as: · Filing an individual Form series return without your knowledge or consent. · Altering your. Unlike other online tax preparation companies, we don't charge a dime to get you the answers you need. We've helped millions of American tax filers successfully. Even if your taxes are complicated, it costs $0 to file—no upsells, no hidden fees. Plus, we include free audit defense with every return. Easy from your. TurboTax may be charging you $39 to pay with your refund because this payment option is known as a refund processing service. The fee covers the. Try marselblog.ru Turbo tax wanted to charge me $, tax free USA only charged me $, and I actually found it much easier to use than. Wondering Why Is TurboTax Charging Me? TurboTax charges a $39 fee if you file your federal return after April 15th. If you don't have time to complete your. You shouldn't need TurboTax to file your taxes. The IRS can and should make “The problems with Free File lead me to conclude that it is time for. According to state authorities, Intuit deceived consumers into thinking they could file their federal taxes for free. In reality, TurboTax allegedly charged for. Those who want to prepare their own taxes can use TurboTax with prices starting at $ Taxpayers who want expert assistance will have a starting payment of $ Why is TurboTax charging me to file my taxes? TurboTax has fees associated with their service, therefore if you choose to file your taxes using their platform. For tax returns filed after the IRS stops processing do-it-yourself e-file. Charged in addition to the construction fee. $ Paper check handling charge. After using Sprintax to file my federal return, Sprintax is charging me to file a state return. Is this correct? International Student Services has. Be sure to review your receipts from Internet and other out-of-state purchases to determine if tax was charged. Why Is There a Use Tax? The use tax, which was. banana. 5 months ago. Process was fine but cost almost nothing compared to turbotax which was going to charge me $ Glad I found you guys first. Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. TurboTax for the Web[2] is available online. You can find local branch she charge me only $95 including e-file. i think she is their to help people. If you file your chart, your taxes with Turbotax, stop what you're doing and listen to this. This is a PSA. If you would like to take your Turbotax. fee out of. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today!

Fast Cash Out Refinance

Cash-Out Refinancing replaces your current mortgage with a new one. This mortgage is for an amount larger than what you currently owe. The excess funds left. Your home is your smartest investment. You have committed to timely mortgage payments and a healthy financial future as a homeowner. A cash-out refinance loan. The cash out refinance rate we may be able to offer you depends on your credit score, income, finances, the current mortgage rate market, and other factors. With a cash-out refinance, you might be able to get a lower interest rate and larger loan amount than with a personal loan or other alternative. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Fast Closing Refinance Loan Programs · Conventional – Conventional loans are available for both rate and term refinancing and cash out refinancing. · FHA Loans –. Best for cashing out full equity: Rocket Mortgage · Best for no lender fees: Ally Bank · Best for a no-frills lender: Better · Best for saving money: SoFi · Best. With a cash-out home refinance, you can replace your current mortgage with a new one for more than what you still owe on your current mortgage. Then, you'll get. Cash-Out Refinancing replaces your current mortgage with a new one. This mortgage is for an amount larger than what you currently owe. Cash-Out Refinancing replaces your current mortgage with a new one. This mortgage is for an amount larger than what you currently owe. The excess funds left. Your home is your smartest investment. You have committed to timely mortgage payments and a healthy financial future as a homeowner. A cash-out refinance loan. The cash out refinance rate we may be able to offer you depends on your credit score, income, finances, the current mortgage rate market, and other factors. With a cash-out refinance, you might be able to get a lower interest rate and larger loan amount than with a personal loan or other alternative. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Fast Closing Refinance Loan Programs · Conventional – Conventional loans are available for both rate and term refinancing and cash out refinancing. · FHA Loans –. Best for cashing out full equity: Rocket Mortgage · Best for no lender fees: Ally Bank · Best for a no-frills lender: Better · Best for saving money: SoFi · Best. With a cash-out home refinance, you can replace your current mortgage with a new one for more than what you still owe on your current mortgage. Then, you'll get. Cash-Out Refinancing replaces your current mortgage with a new one. This mortgage is for an amount larger than what you currently owe.

A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. With a cash-out home refinance, you can replace your current mortgage with a new one for more than what you still owe on your current mortgage. If you ask a loan officer, they'll most likely say anywhere from 30 to 45 days. While this is generally true, there are plenty of instances where it can take. Scaling a mountain of debt can feel impossible — but refinancing your home with a Cash Out Refinance is an easy way to not only lower your payments. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. Getting cash back is one of the most popular reasons people choose to refinance their mortgage. Qualifying borrowers can leverage their home equity to take. Most lenders limit your DTI ratio to no more than 45 percent for a cash-out refinance. Equity: You're required to keep a minimum of 20 percent equity in your. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Fast Closing Refinance Loan Programs · Conventional – Conventional loans are available for both rate and term refinancing and cash out refinancing. · FHA Loans –. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. A cash-out refinance gives you access to cash by utilizing the equity you have already accumulated for your home. Homeowners usually don't reap the benefits. With a conventional loan, you'll need to have owned the house for at least six months to qualify for a cash-out refinance, regardless of how much equity you. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Cash-out refinance benefits · Payoff high-interest credit card debt and/or personal loans · Cash for unexpected expenses · Consolidate a 1st and 2nd mortgage (or. With in-house underwriting and processing we can close loans fast – in as fast as 21 days. Cash out refinancing is a great way to consolidate debt from high. Allow us to assist you in refinancing your mortgage quickly. There are three different cash out refinance programs that are available. This includes. A smart cash-out refinancing could open the door to a bright future. Put yourself in control by turning some of the equity you've built in your home into cash. Cash-out refinance loans are the fast and easy option for real estate investors looking to take equity from an existing investment property to reinvest the. As a direct lender, loanDepot has access to low FHA refinance rates and we can help make the process of refinancing your home fast and easy.

How Can I Add Money To My Google Pay Account

Click on the "Google Pay balance" card and you will be given the option to Transfer Out. Comment Image. Note: Google have now set a $ weekly. If you have multiple accounts in Google Pay, select the account that you'd like to update: If you are prompted to verify your information to continue, call. Seamless payments across all of your devices begin with a few quick steps. Add your card details to your Google Account, and they will be stored safely. You can now add money by using a debit or credit card as well as Apple or Google Pay. This is the fastest and easiest way to fund your N26 account. Open the Google Play app Google Play. · At the top right, tap the profile icon. · Tap Payments & subscriptions and then · Select an amount. · Tap Continue. · Select. Open Google Wallet googleWallet_icon · Select "Add to Wallet" and then "Transit Pass" and then SmarTrip Washington D.C. · Select "Add Money" then enter desired ". You can add cash to your Google Pay account by linking it to a bank account or debit/credit card. You cannot directly add cash using gift cards. Step 1 of 7. To add a payment method, swipe up from the bottom of the screen. · Step 2 of 7. Open the Google Play Store app. · Step 3 of 7. Tap Menu. · Step 4 of. Launch Cash App · Tap the Cash Card (this should be on the home screen) · Select 'Add to Google Pay' if available · Follow the on-screen instructions. Click on the "Google Pay balance" card and you will be given the option to Transfer Out. Comment Image. Note: Google have now set a $ weekly. If you have multiple accounts in Google Pay, select the account that you'd like to update: If you are prompted to verify your information to continue, call. Seamless payments across all of your devices begin with a few quick steps. Add your card details to your Google Account, and they will be stored safely. You can now add money by using a debit or credit card as well as Apple or Google Pay. This is the fastest and easiest way to fund your N26 account. Open the Google Play app Google Play. · At the top right, tap the profile icon. · Tap Payments & subscriptions and then · Select an amount. · Tap Continue. · Select. Open Google Wallet googleWallet_icon · Select "Add to Wallet" and then "Transit Pass" and then SmarTrip Washington D.C. · Select "Add Money" then enter desired ". You can add cash to your Google Pay account by linking it to a bank account or debit/credit card. You cannot directly add cash using gift cards. Step 1 of 7. To add a payment method, swipe up from the bottom of the screen. · Step 2 of 7. Open the Google Play Store app. · Step 3 of 7. Tap Menu. · Step 4 of. Launch Cash App · Tap the Cash Card (this should be on the home screen) · Select 'Add to Google Pay' if available · Follow the on-screen instructions.

Step 2: Once you've selected Google Pay as your payment method, select the card you'd like to pay with, or add a payment card. Step 3: Confirm your purchase. 1. Get the app. Download the Google Pay app from the Google Play store. · 2. Add your cards. Add your ScotiaCard® debit card and Scotiabank Visa* card. · 3. Pay. To add funds to your accounts in the Transact eAccounts app, first save a payment method at the Transact eAccounts website. How Do I Pay with Google Pay? · Unlock your device (no need to open the app). · Hold the back of your device near a contactless payment terminal. · Your phone will. Go to marselblog.ru Click Payment Methods. Click Money in Google Pay or Google Pay balance. Download monthly statements for money in Google Pay. Download the app on Google Play, or visit marselblog.ru · Sign in to your Google Account and add a payment method. · If you want to use Google Pay in stores. You can make faster payments using your Google Pay. Note: First, you'll need to set up your account. Then to use Google Pay for your transfer. To add your PayPal account through the Google Pay app for mobile purchases in-store, log in to Google Pay, tap the icon to add a new payment method, and follow. Google Pay, make sure you have sufficient funds in your PayPal Balance account. There are several ways to add funds to your PayPal Balance account: From. To make purchases on Google Play you can add a payment method to your account right from the Play Store app. Getting started is simple. Open the Google Wallet app or download it on Google Play. Tap 'Add to Wallet', follow the instructions, and verify your card if. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Frequently asked questions · Open Google Wallet app on your device. · At the bottom right, select the + symbol. · Select “Add a credit or debit card.” · Use the. About Cloud Billing accounts and Google payments profiles In Google Cloud, you can set up a self-serve, online Cloud Billing account and use it to define who. When you pay in-store using PayPal with Google Pay, the account will automatically top up if there's not enough money in your PayPal balance. When you sign in to your account, you can see your payment info Google apps. PrivacyTermsHelpAbout. Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more. My Account is Locked · Online & Mobile Banking FAQs. In. Just log in to your Discover account to quickly add your card. Click Can I continue to use my plastic card after I add my Discover card to Google Pay? Can a blocked phone contact send you money through googlepay? Same as Google Pay repeatedly suspends my account when I try to add cards · Whenever I. To reset or confirm your default card, follow the steps below. Note: You'll need to install the Google Wallet app. 1. Open the Google Wallet app. 2. Tap Payment.

Citibank Early Direct Deposit

Citibank® ACH · Consumer-initiated bill payments and pre-authorized debits · Direct deposit of payroll, pension payments and T&E reimbursements · Vendor payments. Finally got one account activated before leaving on trip. The following day, before departure, we tried to pay both accounts. By setting up the mobile app, both. I just switched to Citi bank and before switching my direct deposit I'm trying to determine if they release funds early. Multiple overdraft protection options; Early access to your paycheck with Direct Deposit Early Pay1. Free Online Banking with Bill Pay; Free Mobile Banking2. Make qualifying Enhanced Direct Deposits of $ or more each month to your checking account and Citi will waive your monthly service fee. On preset days, the employer's bank sends direct deposit requests to the ACH, where they are processed and passed on to employees' financial institutions. The. A deposit before PM ET is processed on the same business day. Deposits made after PM ET are viewable (pending) in your account. Generally, a bank must make the first $ from the deposit available—for either cash withdrawal or check writing purposes—at the start of the next business. Wire transfers and electronic direct deposits are also generally available on the same business day your deposit is received. Citibank® ACH · Consumer-initiated bill payments and pre-authorized debits · Direct deposit of payroll, pension payments and T&E reimbursements · Vendor payments. Finally got one account activated before leaving on trip. The following day, before departure, we tried to pay both accounts. By setting up the mobile app, both. I just switched to Citi bank and before switching my direct deposit I'm trying to determine if they release funds early. Multiple overdraft protection options; Early access to your paycheck with Direct Deposit Early Pay1. Free Online Banking with Bill Pay; Free Mobile Banking2. Make qualifying Enhanced Direct Deposits of $ or more each month to your checking account and Citi will waive your monthly service fee. On preset days, the employer's bank sends direct deposit requests to the ACH, where they are processed and passed on to employees' financial institutions. The. A deposit before PM ET is processed on the same business day. Deposits made after PM ET are viewable (pending) in your account. Generally, a bank must make the first $ from the deposit available—for either cash withdrawal or check writing purposes—at the start of the next business. Wire transfers and electronic direct deposits are also generally available on the same business day your deposit is received.

Early Payday · Give your customer's the ability to get direct deposits up to 2 days before payday.

Early Pay grants you access to your eligible direct deposit payments up to two days prior to the scheduled payment date. Federal tax refunds may be received. Get paid up to 2 days early with direct deposit · 1. Depends on the timing of the submission of the payment file from the payer · 2. Terms Apply · 3. See website. We will begin charging interest on a Citi Flex Pay balance subject to an APR at the start of the billing cycle following the billing cycle during which you. If you have more than one Citibank account and you want to debit a different In the First Intermediary Bank Name/Address field, click the Library. What is Enhanced Direct Deposit? An Enhanced Direct Deposit (EDD) is an electronic deposit through the Automated Clearing House (“ACH”) Network of payroll. I just switched to Citi bank and before switching my direct deposit I'm trying to determine if they release funds early. Make an additional deposit of $ or more during the first Evaluation (Direct deposits are set up by the institution or business sending the funds.). in the month of account opening and for 3 months after account opening or; each month the account has $+ in Enhanced Direct Deposits. No fee. Be aware that CDs often come with early withdrawal penalties. Online Citi accounts or making a qualifying direct deposit or bill payment Is. Citi CDs pay up to % APY, depending on the term and balance. You can choose from a No Penalty CD that lets you make early withdrawals of a Step UP CD with a. **An Enhanced Direct Deposit (EDD) is an electronic deposit through the Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC. Electronic direct deposits will be available on the day we receive the available to you on the first business day of your deposit. Depending on the. Unlock financial freedom with Get Paid Early at OneUnited Bank. Access your funds sooner via direct deposit and take control of your finances. Beyond the equal monthly payment options you get as an eligible Citi cardmember, you'll also enjoy the fast and familiar convenience of Amazon Pay when you shop. On NY Demand Deposit accounts, Citi's Sweep Investment will give you the power to automatically invest late arriving or uncommitted funds in an interest-bearing. Get a direct deposit form from your employer or bank. Fill in the information, including bank routing number and your checking account number. Confirm deposit. Be aware that CDs often come with early withdrawal penalties. Online Citi accounts or making a qualifying direct deposit or bill payment Is. Get paid up to two days sooner with early direct deposit. A phone screen $ Citibank, %, $ PNC Bank, %, $ Wells Fargo, %, $ If a longer delay is placed on your deposit, we will tell you when you make the deposit, and the first $ of your 2 An Enhanced Direct Deposit is an. How Can You Earn a Citi Checking Account Bonus? · Open a Citibank®, Citi Priority, Citigold® or Basic Banking checking account. · Make an opening deposit between.

How Hard Is It To Get A 50000 Personal Loan

Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and check your rate without impacting. This is when the lender wants to get proof of your credit and creditworthiness by accessing your credit report and determines what APR to give you. A hard. Do you need a large personal loan? These lenders could give you as much as $50, ; LightStream Personal Loans · % - %* APR with AutoPay · Debt. If you have several different debts and find it hard to keep track of them, combining them into a personal loan can make it easier to focus on sending out just. You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. One of the best ways to determine how hard it might be to get a $50, personal loan is to get pre-qualified. As we mentioned earlier, requirements can vary by. Most borrowers go to a credit union, bank, or online lender for a $50, personal loan. The process for how to get large personal loans may be a little. Need Rs. 50K urgently? Get ₹ online with interest rates starting at 13%* p.a. Check your eligibility and apply for an instant Rs. loan. No. In fact, it's far too easy. Before you agree to a student loan that will likely be hanging around your neck like a dead albatross for. Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and check your rate without impacting. This is when the lender wants to get proof of your credit and creditworthiness by accessing your credit report and determines what APR to give you. A hard. Do you need a large personal loan? These lenders could give you as much as $50, ; LightStream Personal Loans · % - %* APR with AutoPay · Debt. If you have several different debts and find it hard to keep track of them, combining them into a personal loan can make it easier to focus on sending out just. You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. One of the best ways to determine how hard it might be to get a $50, personal loan is to get pre-qualified. As we mentioned earlier, requirements can vary by. Most borrowers go to a credit union, bank, or online lender for a $50, personal loan. The process for how to get large personal loans may be a little. Need Rs. 50K urgently? Get ₹ online with interest rates starting at 13%* p.a. Check your eligibility and apply for an instant Rs. loan. No. In fact, it's far too easy. Before you agree to a student loan that will likely be hanging around your neck like a dead albatross for.

With a low fixed rate, flexible terms, and loan amounts up to $50,, a Personal Loan from Community First can help you get the cash you need with a monthly. How to get a £50, loan with Evolution Money · Proof of address (such as utility bills) · Proof of income (your last 3 months payslips or tax returns) · Proof of. You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. This is when the lender wants to get proof of your credit and creditworthiness by accessing your credit report and determines what APR to give you. A hard. Whether you have good or bad credit, qualifying for a $50, personal loan requires your undivided attention. From locking in the best offer to understanding. Huntington personal loans help make dreams come true. Learn more about our options and apply online for a personal loan. Personal Loan · Get quick access to the money you need. · Personal loan rates as low as % APR · What can I use a personal loan for? · Personal loan calculator. Get up to $50, for debt consolidation, home improvement, or any other major expense. See your personalized initial offer with no impact to your credit score. Flexible loan amounts. You can get a personal loan from $1, to $50,⁵. Fixed rates and terms. Borrow from $2, to $50, Get your funds as soon as 1 business day. No How do I get a personal loan? Prospective borrowers can quickly and. A personal loan doesn't require your home or car as collateral, so you won't have to deal with inspections or appraisals. mobile phone and hand with cash. It is possible to get a $, personal loan, but it's difficult. Even the best personal loan providers don't typically offer loans of more than $50, Personal loans range from $3, to $50, Apply for a Personal Loan. No Can I make extra payments or pay off my personal loan early? Yes, you can. $ to $50, loan amounts. Tiered Rates for the Our simple online application and digital banking* options make it easy to manage your personal loan. Accept your loan offer and you should get your money within a day of clearing necessary verifications. Flexible Personal Loan Options. Select an offer. Choose. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Get an estimate of monthly payments for a. Best if you want: To borrow up to $50, for a vacation, wedding or home remodel. Low interest rates. Checkmark. Tired of working hard to make hefty loan and credit payments each month that just seem to be going toward interest? A personal loan through MCU allows you to. Loan amounts up to $50, Feel confident with a personal loan that How to get a personal loan. 1. Step one. Complete an online application. 2. Step. Whether you need to replace an appliance or do some repairs, a personal loan can make it happen. Debt Consolidation. It's hard to keep track of multiple credit.